By Ambrose O’Callaghan

The year 2025 saw dueling narratives driving perspective in the healthcare space. To start the previous year, tech and growth-oriented sectors were on shaky ground, which thrust defensive factors into favour. Healthcare led the market in this early stage. However, by the late spring season and following “Liberation Day” tariffs, the AI story propelled technology and growth factors had taken back momentum.

Now, as we enter the second month of 2026, it is worth looking back on the space. Some areas of healthcare continue to deliver, while others have struggled. Today, we will provide a quick snapshot of the sector and look at two of Canada’s largest healthcare ETFs that also provide consistent income.

Healthcare: Winter 2026 checkup

The healthcare sector has demonstrated both defensive and growth-oriented qualities through its history. Healthcare is defensive because of the essential nature of its services. On the other hand, its growth qualities stem from the high demand for specialized products as well as technological innovations.

Some of the biggest names in the healthcare space were beneficiaries of earnings beats throughout the summer season. Even still, the positive results failed to provide a bullish catalyst. Meanwhile, companies that posted earnings misses were punished more severely in the market. Fundamental issues in the managed care segment did weight on the healthcare sector for much of the year. Fortunately, those headwinds have largely stabilized.

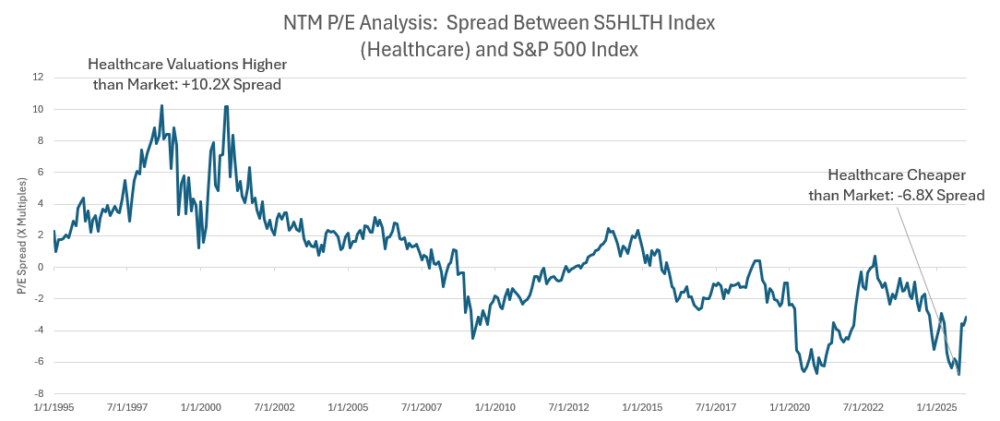

This is what valuations looked like in the healthcare space at the end of January:

Source: Harvest ETFs, January 30, 2026.

Valuations had compressed in the healthcare space relative to the broader market. In this climate, investors searched for catalysts for a rebound.

Those catalysts included Warren Buffett’s UnitedHealth purchases in the late summer, as well as headlines that have focused on the issues of reshoring and repatriation. Pfizer and AstraZeneca were able to secure multi-year tariff exemptions through pricing deals as well as commitments to the ruling administration’s platform. Eli Lilly, Johnson & Johnson, and Merck have also pledged billions to expand their U.S. operations.

Eli Lilly surged in February following the release of its fourth quarter results. The company surged past estimates and delivered revenues of nearly US$20 billion on the back of sales in its weight-loss drug Zepbound and diabetes treatment Mounjaro. For 2026, Eli Lilly projected revenue between US$80-83 billion.

HHL & HHLE | Healthcare ETFs with Monthly Income

The Harvest Healthcare Leaders Income ETF (TSX: HHL) is Canada’s largest covered call healthcare ETF. It offers access to an equally-weighted portfolio of 20 large-cap global healthcare companies, selected for their potential to provide steady income and long-term capital appreciation. HHL is available in multiple currency classes, including hedged, unhedged, and a U class ETF.

HHL Wins Fundata A+ FundGrade

On February 6, 2026, the Harvest Healthcare Leaders Income ETF was awarded the Fundata A+ FundGrade. The FundGrade rating system incorporates up to 10 years of history, using metrics like Sharpe Ratio, Sortino Ratio, and others to rank the best investment funds in Canada. HHL is managed by Harvest ETFs President and Co-CIO Paul MacDonald.

Annual Performance

As at January 31, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 4Y | 5Y | 7Y | 8Y | 10Y | 11Y | SI |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| HHL | (0.59) | 5.13 | 15.22 | (0.59) | 3.16 | 5.00 | 7.15 | 6.51 | 8.82 | 8.55 | 7.59 | 8.21 | 7.07 | 6.93 |

| HHL.B | (1.26) | 2.56 | 14.24 | (1.26) | (1.51) | 7.17 | 9.22 | 9.48 | 11.11 | - | - | - | - | 10.38 |

| HHL.U | (0.47) | 5.65 | 16.25 | (0.47) | 5.12 | 6.49 | 8.38 | 7.62 | 9.72 | 9.58 | 8.59 | - | - | 9.43 |

The Harvest Healthcare Leaders Enhanced Income ETF (TSX: HHLE) is a levered version of HHL, for investors who are hungry for more torque and monthly income. This ETF applies modest leverage of approximately 25% to an investment in HHL.

Annual Performance

As at January 31, 2026

Disclaimer

The content of this article should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or use to engage in personal investment strategies. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds”). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available Class units of the Fund you own. If a Fund earns less than the amounts distributed, the difference is a return of capital.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the ETF but represents the distribution an investor would receive if the most recent distribution stayed the same going forward.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. It reflects risk‑adjusted performance and is based on Fundata’s GPA‑style 12‑month methodology with assigned grades A to E and corresponding scores 4 to 0. Funds with a GPA of 3.5+ receive a FundGrade A+®. There are 21 ETFs in the Health Care Equity category (CIFSC). For full methodology, visit www.FundGradeAwards.com.