Principal Consultant at Double R Consulting Group, Investment Advisor and Portfolio Manager (Retired), CIBC Wood Gundy

Women advisors have a huge opportunity in the wealth management industry and one way to take advantage of it is through a holistic approach to investments and financial planning, says Ann Richards.

That means working with clients to create a plan and offering investment options, says Ms. Richards, who recently retired after 25 years as an investment advisor and portfolio manager with CIBC Wood Gundy. It also involves understanding where the plan fits into the client’s family situation, lifestyle and aspirations.

“You have to focus on the overall picture; the emotional side of things,” she says.

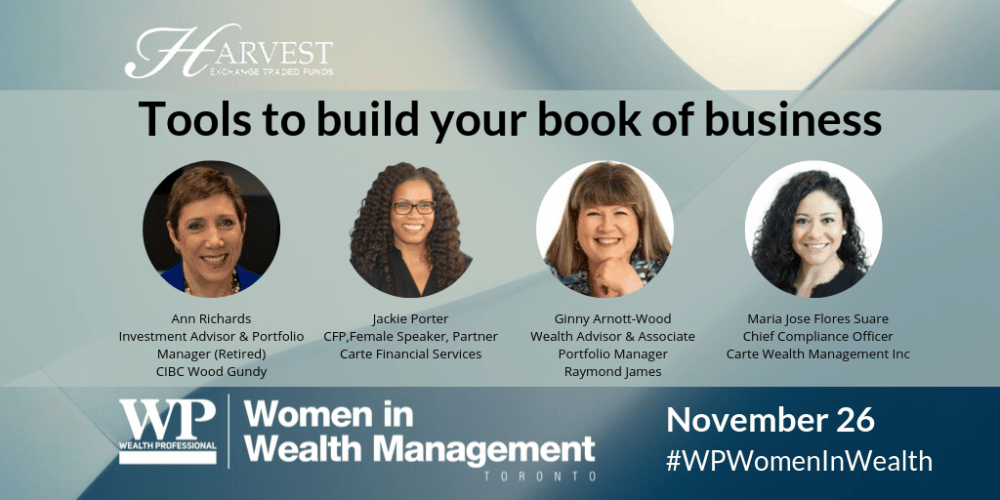

Ms. Richards is now consulting to small businesses on account management and client relations and will be moderating a panel at the upcoming Women in Wealth Management Conference on November 26 at the Steam Whistle Roundhouse in Toronto. The conference is sponsored in part by Harvest Portfolios Group.

“I’m thrilled that we are celebrating women in wealth management and pleased I can share my experience,” Ms. Richards says.

She has numerous professional designations, including Certified Investment Manager (CIM), Certified Financial Planner (CFP), Elder Planning Counsellor (EPC) and Life License Level II designations.

Ms. Richards is a Fellow of the Canadian Securities Institute (FCSI). It is recognized as the highest honour in the financial services industry. This designation is reserved for financial services professionals who are experienced, have achieved the highest levels of advanced education and been endorsed by their peers and superiors.

Ms. Richards earned a degree in Mathematics from the University of British Columbia and also has a CPA designation. Before joining Wood Gundy, she globe trotted, gaining experience as a chief accountant for a Vancouver junior gold miner, working as a senior finance manager with an IT firm in Sydney, Australia, and later with an accounting firm in London, England.

She says men and women tend to view financial planning differently. In client meetings, men tend to want to know how a stock is doing or hear about a new recommendation and the math behind that pick.

“Men are more data driven, while women are often more interested in having a conversation,” she says.

The conversation with both partners helps form an understanding of family needs, whether paying for an upcoming wedding, extended travel, or helping a grandchild with university tuition.

Her advice for women building a practice is that the first five years or so will involve a lot of long days. While social media is well and good, nothing beats the personal touch. That involves as many face-to-face meetings as possible with prospects – at the office, visiting them at home or at business and social events.

“It helps establish a connection,” she says.

The process involves a mental toughness, because reaching out to strangers and making a pitch means plenty of failures for each new client gained.

“You have to remember that you are in sales and to succeed you have to be able to pick yourself up after being rejected.”

You must also be a self-starter, she says. You have to accept that when it comes to managing other people’s money you may be right most of the time, but sometimes things won’t turn out as planned. Investments go down. You have to be able to weather the criticism and bounce back.

“You still have to be able to sleep at night,” she says.

Given the decade-long expansion for stock markets, a pullback lies ahead. Clients will be nervous and need reassurance.

“You have to be able to maintain your composure when things don’t go as planned.”

Ms. Richards says the wealth management field offers a lot of opportunity for women and given that only 20 per cent of advisors are female, there is plenty of room for more advisors who are female. Once you have built a practice you are rewarded by being your own boss, setting your own hours and deciding which clients to work with.

Her number one piece of advice?

“Remember that this is a profession and you are doing something that others cannot. Take pride in that.“

Harvest is proud to be a Gold Sponsor for Wealth Professional Women in Wealth Management (Toronto) Event 2019.

For more on Harvest ETF’s click here.

The views and/or opinions expressed in the blog are of a general nature and are for informational purposes only. Blog contents should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or used to engage in personal investment strategies. Investors should consult their investment advisor before making any investment decision.