The word Metaverse has quickly become part of the investment vocabulary, but it is a fairly vague term.

It refers to shared environments which are created on the internet, or through sophisticated software, which simulate the real world. In one sense, things in the Metaverse aren’t real because they have no physical form. On the other, they are very real because they can be experienced and appear lifelike through things like virtual reality (VR) or augmented reality (AR).

At Harvest Portfolios Group, we are already in the Metaverse through four ETFs – the Harvest Tech Achievers Growth & Income ETF (HTA:TSX), the Blockchain Technologies ETF(HBLK:TSX), and the Harvest Brand Leaders Plus Income ETF (HBF:TSX) As the Metaverse grows, we grow with it through the ownership of the companies on the leading edge of its development.

“New technologies change the way we do things, but the change tends to be continuous and incremental, rather than instantaneous and dramatic,” says Harvest CEO Michael Kovacs. “The companies in our ETFs are leaders in their area. They can invest in the R&D, they have the resources to acquire start-ups, to learn about the technology and the leeway to make mistakes.”

Harvest’s Blockchain Technologies ETF was Canada’s first blockchain ETF and holds a cross section of large capitalization technology companies and emerging stand-alone blockchain companies.

The Harvest Tech Achievers Growth & Income ETF holds 20 of the large global technology names. It is a core technology holding owning a portfolio of dynamic and growing businesses that are diversified across the global technology sectors.

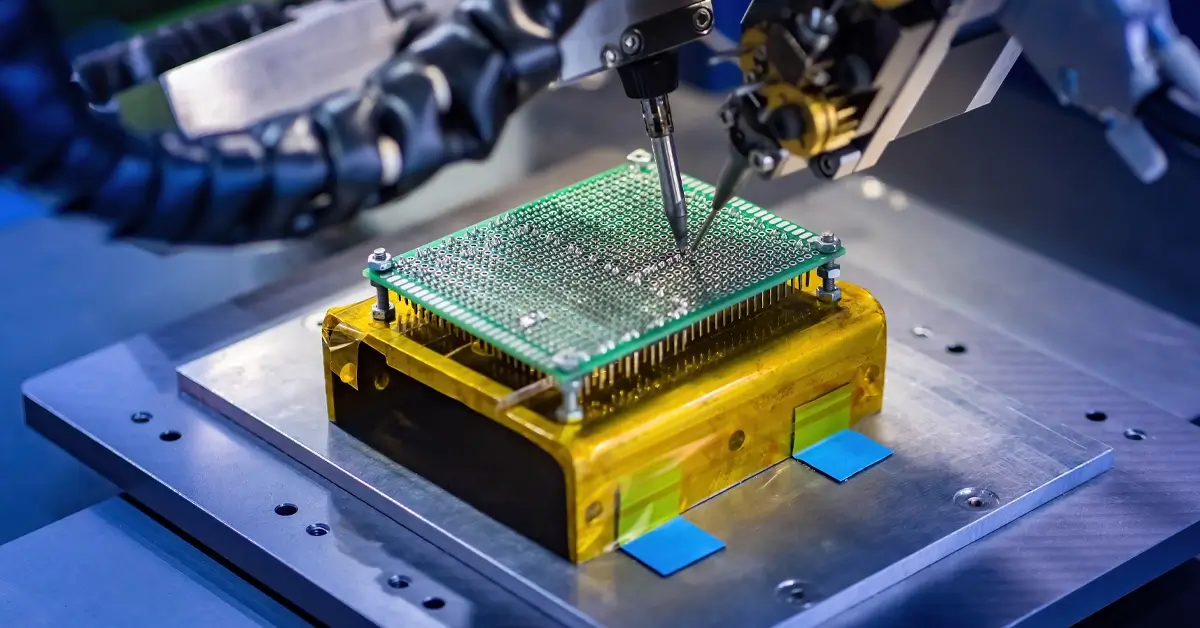

These ETFs offer investors a safe way to take advantage of growth in these areas while relying on core businesses to generate revenues, profits and dividends. They are involved in the metaverse’s value chain. This includes the development of hardware and software, building the communications networks cloud storage of information and platforms that combine semiconductors with digital platforms.

Retailers are offering customers 3D views of their products online, healthcare applications are using 3D or immersive technology now train nurses and medical students and also give surgeons a better visual guide to surgery.

The Harvest ETFs offer ways to capture this potential whichever way it goes. Here a few examples:

Microsoft Corp. has won contracts worth US $22 billion contract with the US military for augmented reality headsets. It is working with Greece’s Tourisms ministry to offer an augmented reality tour of historic sites. It is also teaming up with Meta to enhance Microsoft Teams.

Nike Inc. has filed seven trademark applications that include its intent to make and sell virtual branded sneakers and apparel. These digital fashion lines will be used to ‘dress up’ personal avatars.

Akamai Technologies Inc. provides web and Internet security services. Akamai’s Intelligent Edge Platform is one of the world’s largest distributed computing platforms. Blockchain-powered metaverses that use crypto currency assets will play a huge role in the development of the metaverse. This is because users need to be able to make purchases safely and seamlessly and be able to move their avatar and virtual assets from one world to another.

To find out how your clients can benefit from this strategy call 1-866-998-8298.

For more on Harvest ETFs click here.