By Ambrose O’Callaghan

More Canadian investors are turning to income-yielding investment instruments in recent years. Uncertainty in the market and the need to supplement income in the face of rising personal debt has contributed to this phenomenon. Harvest ETFs has been a pioneer in delivering income in the mutual fund and ETF space for more than 15 years.

Harvest Premium Yield ETFs, launched on January 21, 2026, represent an innovation for Harvest income ETFs. These ETFs will pay out income twice per month. The Premium Yield lineup seeks to complement our extensive and innovative income ETF offerings.

In this article, we’ll focus on the Harvest Premium Yield Canadian Bank ETF (TSX: HPYB). HPYB provides access to a portfolio of six leading Canadian bank equity securities. It offers twice monthly cash distributions with opportunity for capital growth.

Canada’s Big Six Banks | Soaring to New Heights

The S&P/TSX Composite Index has put together a strong performance over the past one-year, delivering gains of 31% as of late afternoon trading on Monday, January 19, 2026. Canada’s big six banks – Royal Bank of Canada, Toronto-Dominion Bank, Bank of Montreal, Scotiabank, CIBC (Canadian Imperial Bank of Commerce), and National Bank of Canada are all within the top 25 largest equities by market cap on the TSX index. Royal Bank and TD Bank make up two out of the top three, with Royal Bank as the largest by overall market cap.

Canada’s big six banks played a significant role in this run up for the broader market.

Historical Canadian Bank Return

Let’s take a quick snapshot of each of the Big Six:

Royal Bank of Canada | Canada’s Largest Bank

2025 Financial Highlights: Adjusted net income of $20.9 billion up 20% compared to the previous year. Adjusted diluted earnings per share climbed 19% year-over-year to $14.43.

Contributors: Higher revenues in the Global Markets and Corporate & Investment Banking in Capital Markets, as well as higher fee-based revenue in its Wealth Management division.

Toronto-Dominion Bank | A Juggernaut with a Huge US Presence

2025 Financial Highlights: Adjusted net income of $15 billion and adjusted diluted earnings per share of $8.37 in 2025 – up from $14.2 billion and $7.81, respectively, in the prior year.

Contributors: Canadian Personal and Commercial Banking segments, record revenue, deposit, and loan volumes. U.S. balance sheet restructuring activities and lower PCL.

Bank of Montreal | Pioneer of Canadian Banking (Founded in 1817)

2025 Financial Highlights: Adjusted net income of $9.24 billion in 2025 – up 24% compared to $7.44 billion in the previous year. Adjusted EPS rose 26% to $12.16.

Contributors: Growth across all its diversified business segments.

Scotiabank | A Global Canadian Bank (Operates in Canada, US, Mexico | Presence in Europe, Latin America and Asia Pacific)

2025 Financial Highlights: Adjusted net income of $9.51 billion – up from $8.62 billion in the previous year. Diluted EPS rose from $6.47 in fiscal 2024 to $7.09.

Contributors: Adjusted earnings growth of 2% in International Banking, 17% in its Global Wealth Management segment, and 30% earnings growth in its Global Banking and Markets segment.

CIBC | Canada’s Client-Focused Bank

2025 Financial Highlights: Adjusted EPS of $2.21 in 2025, rising 16% compared to the previous year. Adjusted return on equity was reported at 14.4%,

Contributors: Capital Markets business segment due to active trading and underwriting and advisory businesses.

National Bank | A Quebec-based Financial Titan (Largest bank in Quebec)

2025 Financial Highlights: Adjusted net income of $4.48 billion in 2025 – up 21% compared to the prior year. Adjusted EPS climbed 9% to $11.28.

Contributors: Adjusted net income growth of 17% in its Wealth Management segment, net income growth of 34% in its Capital Market segment, and 12% net income growth in its U.S. Specialty Finance and International segment.

Canadian banks had a banner year in 2025, despite some troubling headlines on the domestic front. In our recent Canada Core piece, we touched on the ongoing trade war shook the Canadian political scene. A new government introduced a budget that promised to “harness [Canada’s] strengths” in laying out a “generational investment strategy – to supercharge growth” targeting areas like “crucial minerals, housing construction, artificial intelligence, life sciences” and more.

Canadian bank stocks have soared to all-time highs in this environment. Some investors may be questioning just how much higher Canadian bank stocks can go. A dynamic strategy that utilizes puts and covered calls could work to circumvent more turbulent market conditions. This ensures that investors can take advantage with high yields even in down markets.

The Core Premium Yield Strategy | Adjusting in Variety of Market Conditions

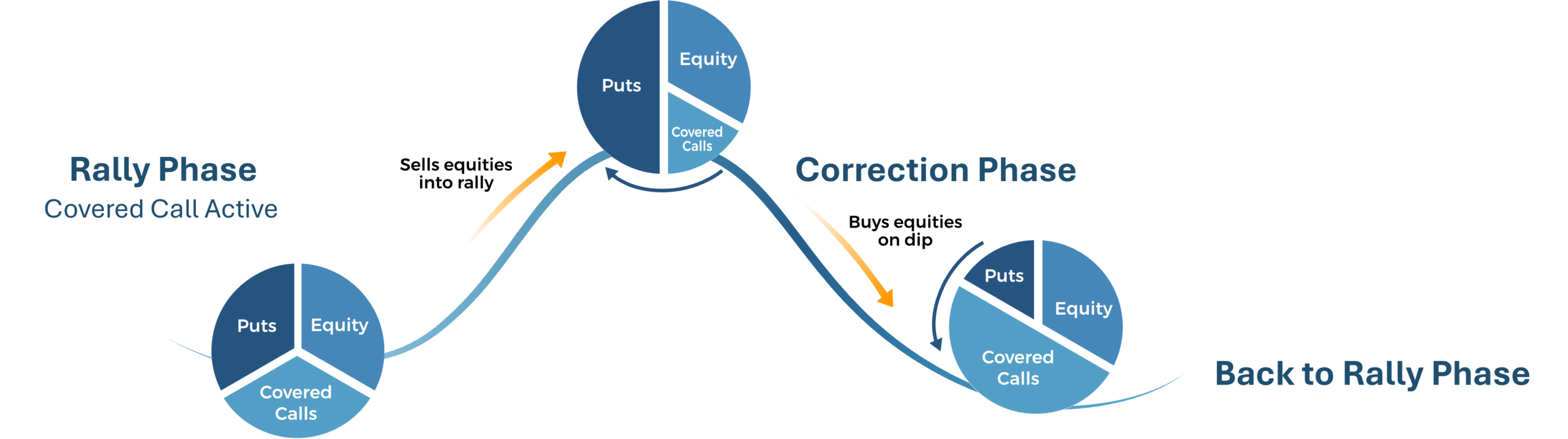

The Harvest Premium Yield active equity income strategy is built on the utilization of written puts, covered calls, and cash borrowing. Illustrated below as the wheel, showing a strategy that aims to generate income based on changing market conditions.

Dynamically Adjusting to Markets

In this strategy, as equities rally, a portion of calls will be assigned. Moreover, allocation shifts to OTM puts. This is done to generate income, and rebuy equity at lower prices. When equities fall, a portion of puts will be assigned. In this bearish environment, allocation shifts to OTM calls, designed to generate income, and sell equity at higher prices. This strategy also allows for the ability to hedge with downside puts.

In addition, using a combination of written puts and cash borrowing, the Harvest Premium Yield Canadian Bank ETF offers levered exposure to enhance income and growth potential.

Combining Canadian Stalwarts with a Dynamic Income Strategy | HPYB

The Harvest Premium Yield Canadian Bank ETF (TSX: HPYB) offers exposure to a portfolio of the six leading Canadian bank equities that we have covered today. It is the first Harvest ETF that will pay income twice monthly to unitholders. That means that unitholders will be provided with additional cash flexibility mid-month, compared to other income ETFs that pay bi-monthly.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds managed by Harvest Portfolios Group Inc. (the “Funds”). Please read the relevant prospectus before investing. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into available Class units of the Fund you own. If a Fund earns less than the amounts distributed, the difference is a return of capital.

The Fund is categorized as a liquid alternative ETF. This means it has the ability to use leverage and can invest more than 10% of its assets in a single issuer. The Fund employs moderate leverage which using a combination of written puts and cash borrowing.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.