Insights

Stay informed and educated with topical insights from Harvest ETFs professionals

Should You Drive the Digital Highways?

In this edition of Money Focus, learn how to access the upside of digital giants like Amazon and Nvidia with Harvest High Income Shares ETFs.

Q&A on New Harvest Bitcoin Income ETFs

Harvest ETFs President and CEO Michael Kovacs discusses the future of Bitcoin and why he launched two Harvest Bitcoin ETFs.

Where Does the Tech Sector Stand After Winter Earnings Season?

By Ambrose O’Callaghan The technology sector has put together a strong performance in the year-over-year period as of early afternoon trading on Tuesday, February 6, 2024. For example, the S&P 500 Information Technology Index has delivered a year-over-year return...

HHL: A Healthcare ETF That Has Delivered Monthly Income and Top Tier Growth for Nearly a Decade

The Harvest Healthcare Leaders Income ETF (HHL:TSX) boasts an impressive track record as it navigates healthcare opportunities in 2024.

An ETF for Dividends & Covered Calls holding Large Canadian Companies

Many leading Canadian companies are known for their dividends.

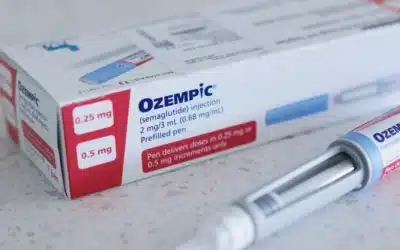

A Popular Healthcare ETF That Could Gain from the Immense Weight Loss Market

Canadians who are hungry for cashflow in the current economic environment should be aware of the benefits of covered call ETFs…

Beyond the 60/40 Rule: The Rise of Equity Income with Covered Calls in Canada

Investors follow the 60/40 rule because they are told bonds…

Navigating Short, Medium, and Long-Duration Fixed Income in 2024

By Ambrose O'Callaghan Fixed income securities are financial instruments that have defined terms between a borrower, or issuer, and a lender, or investor. Bonds are typically issued by a government, corporation, federal agency, or other organization. These financial...

Cash Flow in Retirement: Why Covered Call ETFs Should Be Considered

By Ambrose O'Callaghan Cash Flow in Retirement: Why Covered Call ETFs Should Be Considered It is no secret that Canada is wrestling with an aging population. Indeed, new data from Statistics Canada indicates that it is likely that more Canadians will be leaving the...

Harvest ETFs in 2023: A Year in Review

By Ambrose O'Callaghan Harvest ETFs in 2023: A Year in Review The past year has been a hectic one for Canadian investors. However, despite the turbulence, the S&P/TSX Composite Index was still up 5.1% so far in 2023 as of close on Wednesday, December 13. Canadian...

When Should You Invest in Bonds?

By Ambrose O'Callaghan When Should You Invest in Bonds? Bonds were viewed as a conservative, even boring, asset class coming into the latter half of the 2000s. However, the 2007-2008 financial crisis changed that viewpoint. Bonds significantly outperformed stocks over...

Disclaimer

For Information Purposes Only. All comments, opinions and views expressed are of a general nature and should not be considered as advice and/or a recommendation to purchase or sell the mentioned securities or used to engage in personal investment strategies.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds, managed by Harvest Portfolios Group Inc. (the Fund(s)). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into Class A, Class B or Class U units of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital. Tax, investment and all other decisions should be made with guidance from a qualified professional.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the ETF but represents the distribution an investor would receive if the most recent distribution stayed the same going forward.

Certain statements in the Harvest Insights are forward looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS.

FLS are not guarantees of future performance and are by their nature based on numerous assumptions, which include, amongst other things, that (i) the Fund can attract and maintain investors and have sufficient capital under management to effect their investment strategies, (ii) the investment strategies will produce the results intended by the portfolio managers, and (iii) the markets will react and perform in a manner consistent with the investment strategies. Although the FLS contained herein are based upon what the portfolio manager believe to be reasonable assumptions, the portfolio manager cannot assure that actual results will be consistent with these FLS.

Unless required by applicable law, Harvest Portfolios Group Inc. does not undertake, and specifically disclaim, any intention or obligation to update or revise any FLS, whether as a result of new information, future events or otherwise.