By Caroline Grimont

I’ve talked a lot about how 2025 has been marked by upheaval and change. One of the things that I’ve found particularly challenging to navigate in this current environment is the constantly changing news cycle, whether that’s around wars, or tariffs, or elections, or anything else.

I’ve already shared my 5-step toolkit for dealing with volatility (Keep calm, remember your financial plan, don’t make hasty decisions, go for a walk, and look for alternatives.) But some of you, my loyal readers, have asked where I got this toolkit in the first place. There’s no direct answer. My toolkit is a patchwork solution that works for me. But each step has been gleaned from a mix of my own personal experience, as well as my voracious readings. I thought it might be helpful for me to share some of my favourite books with you, along with some key lessons I’ve learnt from each. Today I thought I’d start with Annie Duke’s “Thinking in Bets – Making Smarter Decisions When You Don’t Have All the Facts.”

Source: Imagery Courtesy of “Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts (2018)” Annie Duke, published by Portfolio, an imprint of Penguin Random House.

Who’s Annie Duke And Why Should I Listen to Her?

Annie Duke is an American former poker player. She’s not just any poker player. Wikipedia calls her the “Duchess of Poker.” She is among the top five women who have won the most money in the World Series of Poker history. In ‘Thinking in Bets’ she says she has won over $4 million in poker, and her brother Howard Lederer has won over $6.5 million. Yes, he’s a professional poker player too.

I don’t know about you, but I am not a poker player. I’m great fun at the casino.

I thought, well if anyone knows how to make split second decisions, it would be a poker player. That’s why I picked up the book, and I’m glad I did, because I learnt a lot.

What’s ‘Thinking in Bets’ About?

In ‘Thinking in Bets’ Duke talks about how to make better decisions, especially when you’re surrounded by pressure, or chaos. Ideal for the times we’re in, really. She explains that the best way to do this is to focus on probabilities, not certainty. Right at the start, she argues that most of us, myself included, remember our decisions being good or bad based on the outcomes of those decisions. But that, she explains, doesn’t make sense, because luck and factors outside our control could play a big role in the outcomes. To Duke, the most important part of decision making is to use your skills to make the decision and then don’t sweat the outcome too much. If it ends up bad, question the skill involved in making the decision. If that can be improved, improve it. Otherwise, accept that the outcome likely had some other factors involved.

The second section of the book is called, “Wanna Bet?” Duke argues that all decisions we make are bets. Framing our beliefs and predictions as bets helps us clarify how confident we really are in our decisions. It makes us ask ourselves questions like,

- How do I know this? Where did the information come from?

- Do I trust my source? How much?

- What am I missing?

The minute you bet, you have skin in the game, and suddenly, you take things more seriously. But then, in the third section, Duke talks about using bets to learn. Get feedback from your outcomes and use them to make better decisions going ahead. Solid advice, especially in investing.

The fourth section talks about accountability, in a way. Or about confirmation bias – we seek out news that confirms are viewpoints, and then go, ‘AHA! I knew it!’ We also tend to downplay or outright ignore points of view that contradict our own. Duke advises against this and recommends that we create a trusted circle that values accuracy over agreement and holds each other accountable to high standards of reasoning. She also recommends keeping a journal to document your decisions, your rationale behind those decisions, and the eventual outcomes. You could learn a lot from that.

Are there Lessons for Investors from ‘Thinking in Bets’

There are many lessons one could learn from ‘Thinking in Bets,’ but I think these five may resonate with investors:

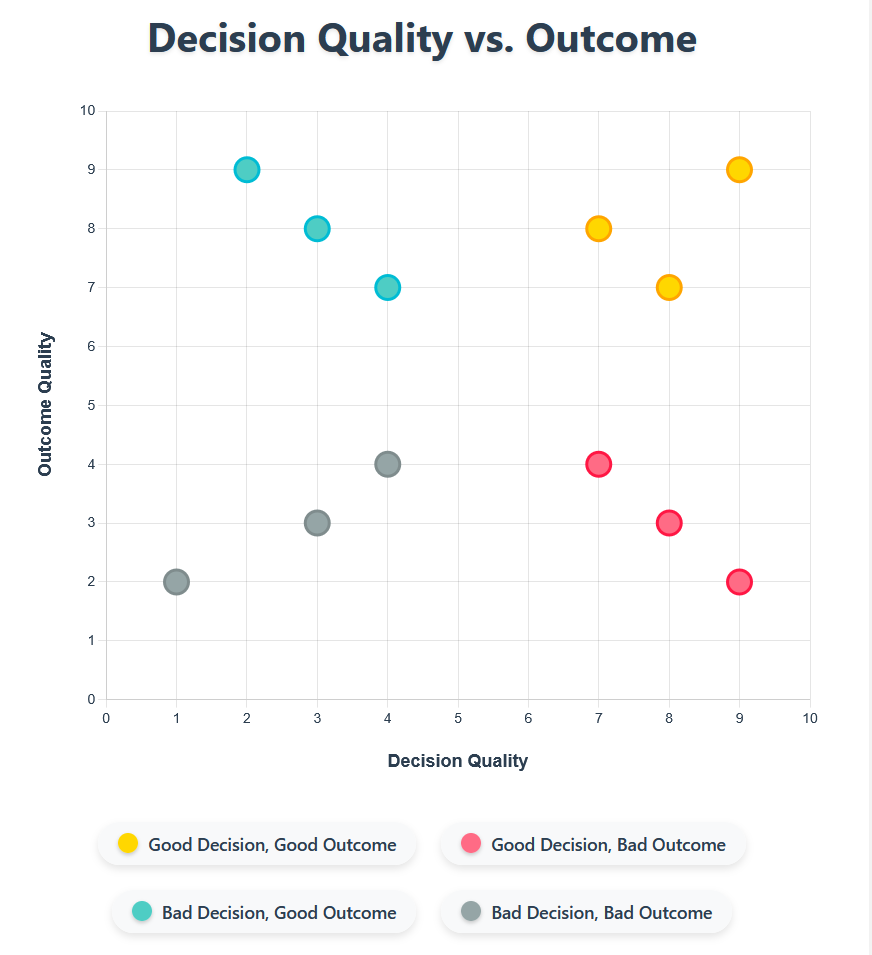

1. Decisions and Outcomes Are Not Equal

Or: Past Performance Does Not Indicate Future Returns.

Sometimes, we make a good decision, and it does not always work out the way we’d like. For example, say you bought a good company right before a negative report came out. It is nearly impossible for a regular investor to have all the information that goes into every stock, and sometimes, stock markets rise and fall on sentiment, which can be very hard to accurately predict. This is why we always say that past performance does not guarantee future returns. In the short-term, fluctuations happen. But if your investment thesis, risk assessment, and time horizon were sound, chances are that you might be able to ride out the short-term volatility into longer-term success.

Source: Illustration of concepts explored in “Thinking in Bets: Making Smarter Decisions When You Don’t Have All the Facts (2018)” by Annie Duke (2018).

2. It Is Better to Think in Probabilities Rather Than Certainties

Or: No One Can Guarantee Returns

If someone comes up to you and tells you a stock investment has a “guaranteed return,” run. There are many things that impact a stock price. Outcomes are never certain. It is better to consider a range of outcomes – best case, worst case, base case – and prepare yourself what could happen in any of them, rather than putting all of your bets on a hope of a certain return.

3. Maintain a Decision Journal

Or: Track Your Portfolio on a Regular Basis

Why did you buy a particular stock? What was your rationale? How long did you intend to hold on to it? Did it play out the way you expected? Ask yourself these questions and actually note down the answers somewhere. Over time, this will help you see why you made the decisions you did, and you might even end up learning a thing or two about yourself!

4. The Buddy System / Dissent to Win

Or: Diversification Is the Only Free Lunch

I know that this generally refers to diversification at the portfolio level, but for me, it means also looking at diversity of thought. For example, if most people are saying something – a stock, an idea, an NFT – is a good thing, who disagrees and why? Maybe sometimes the ones disagreeing are doing so for half-baked reasons. If that’s the case, feel free to ignore them. But oftentimes, I find that when I look for people who actively disagree with what I think, whether I take their view-point or not, it forces me to reckon with things that I wouldn’t otherwise have done.

5. Learn From Your Mistakes

Or: Learn From Your Mistakes

No one can accurately predict the market 100% of the time. I know I said earlier in this piece to bet on probabilities and not certainties (Annie Duke said it first) but I will go against my own advice and predict with certainty that you will not be the first to get every single stock pick right 100% of the time. You just won’t. Neither will I. And neither will Warren Buffett. The important thing is to learn from every mistake, and use those learnings to make yourself a better investor.

What’s the Final Bet?

These are the things I learnt from ‘Thinking in Bets.’ If you’d like me to review your favourite investing book next, let me know, and I’ll squeeze it into my schedule. And if you’re looking to invest in some well-known stocks like Apple, Microsoft, Nvidia, Amazon, or many more, but also want a regular income, and are willing to sacrifice a little bit of that upside for a regular cash flow, you could consider the Harvest suite of single stock ETFs.

Disclaimer

The information is meant to provide general information for educational purposes. Any security mentioned herein is for it to bring awareness it or is for illustrative purposes and should not be taken as an invitation to purchase or sell such security. With regards to Harvest suite of single stock ETFs, commissions, management fees and expenses all may be associated with investing in the Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated.