By Ambrose O’Callaghan

According to Aristotle, “The adventure is worth it.” Does that value still hold true a few thousands years down the line?

Inflation in the developed world has led to rising costs for everyday essentials, including food, fuel, and housing. Canadians looking to take a break from those everyday realities aren’t getting a break for their wallet. On the contrary, travel and leisure activities have grown ever more expensive in the post-COVID economy. These rising costs could come in the form of an airline ticket, or a hotel stay.

Isn’t it about time these companies put some money in your pocket? The Harvest Travel & Leisure Income ETF (TRVI:TSX) captures the long-term growth prospects of travel & leisure while delivering high income every month. This ETF holds a diversified portfolio of travel companies and earns a high dividend yield through an active and flexible covered call strategy.

The travel & leisure sector: Unsung and on a tear

The travel and leisure sector captured investors’ imagination on the expected rebound in post-COVID travel. That rebound occurred in early 2021 but was not sustainable, as news related to continued COVID outbreaks, variants, and vaccine success gave rise to strong up and down swings in the sector.

In 2022, the sector along with the broader market suffered from central banks fight to reign in inflation. This saw investors growing more wary due to the volatile nature of this sector.

However, investors may have missed the forest while staring at the trees in this space. So, it may be worth going over the long-term growth drivers in this sector.

Long-term drivers in the travel & leisure space

There are several long-term drivers for travel and leisure, below we focused on a few of the major ones.

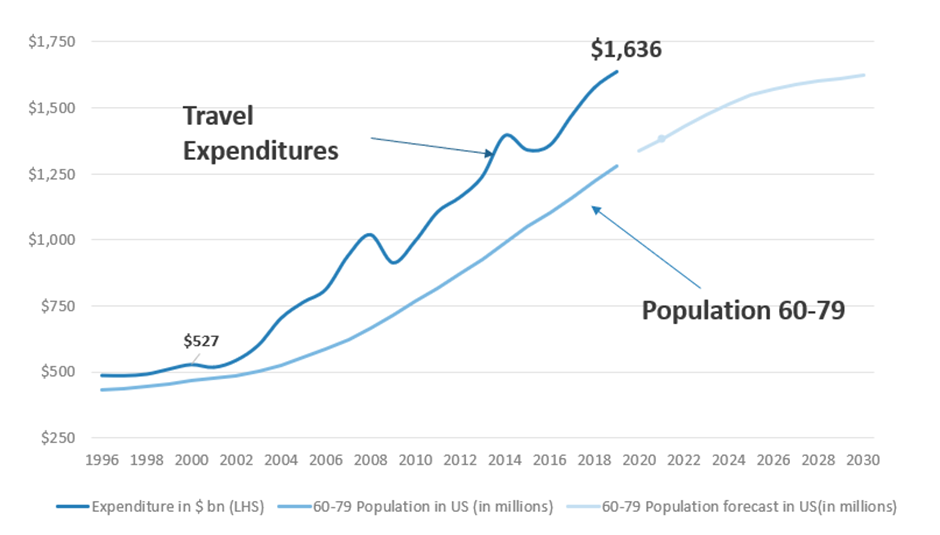

- Baby Boomers: Total tourism spending is increasing in line with the growth of the 60 and above population cohort in the United States. Baby boomers are entering retirement and are looking to spend a higher percentage of their time and dollars on travel and leisure. The chart below illustrates this trend.

- Accessibility: Travel has grown much more accessible due to the widespread adoption of air transport and technology. The number of unique source-destination pairs have more than doubled in the last quarter century. At the same time, the cost of air travel has almost halved during the same period. Meanwhile, technology has made travel more accessible by increasing the ease of both planning and booking your travel. Many websites are available to compare your options and book at the cheapest rate.

- Robust Spending: Millennials and baby boomers are spending more on travel and leisure. That represents a strong tailwind for the sector, as these are the most populous demographics in the developed world. The spending trend has increased in the post-pandemic world, as individuals perceive it as a more essential form of spending than previously.

- Social Media: Social media has created a network that, in effect, has led to people undertaking more travel and leisure spending. People posting about their travel and leisure experiences on social media leads to their followers desiring to undertake similar experiences of their own.

Consistent growth pre-pandemic correlated with aging populations

Source: United Nations Department of Economic and Social Affairs Population Dynamics, World Bank Data – International Tourism Expenditures; December, 2020. Dotted line represents forecasts.

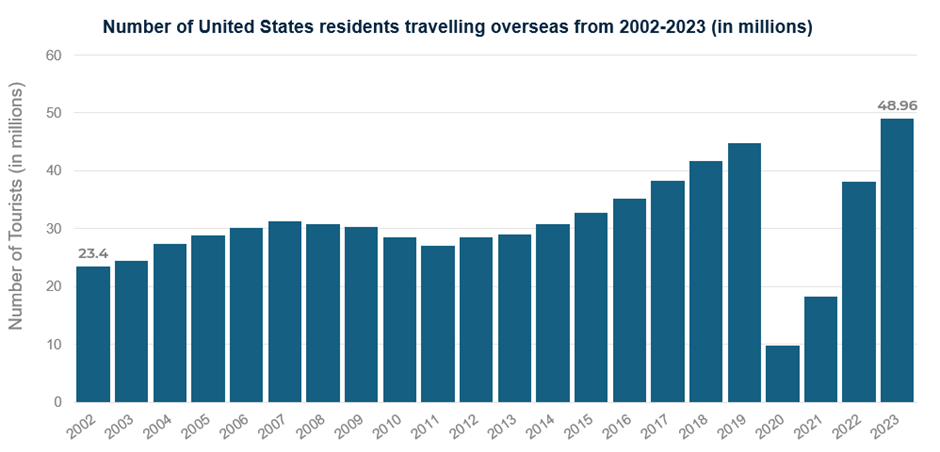

All these factors lead to an accelerated growth in spending towards the travel and leisure sector. The chart below illustrates the growth in the number of US outbound tourists, which has more than doubled between 2002 and 2023. During that same period, the total population grew by approximately 20%.

Source: “Travel: Overseas Tourism US 2002-2023 | Statista.” Statista, Statista, March 2024, www.statista.com/statistics/214774/number-of-outbound-tourists-from-the-us/

The short-term outlook for the travel and leisure space also remains robust.

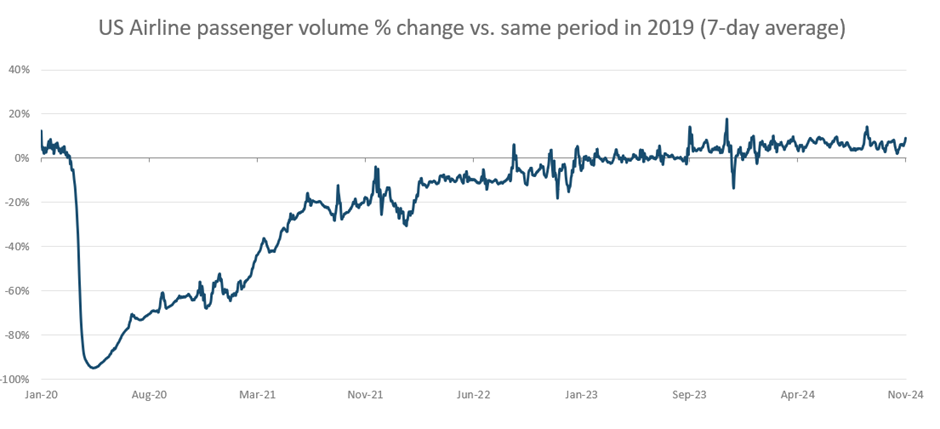

Airline passengers in the US have grown above pre-pandemic numbers and have stabilized. This – coupled with tighter supply growth – has made for a favourable pricing environment for commercial airliners. Indeed, airliners are well-positioned to increase their revenue and earnings growth as well as profit margins. This is especially true for airlines that are focused on increasing premium seating, loyalty offerings, and international routes. With such a focus, the number of premium seats on airlines is projected to increase to 53 per flight in 2026 from 31 in 2019.

US airline passenger volumes rising towards pre-pandemic numbers

Source: tsa.gov, November 26, 2024.

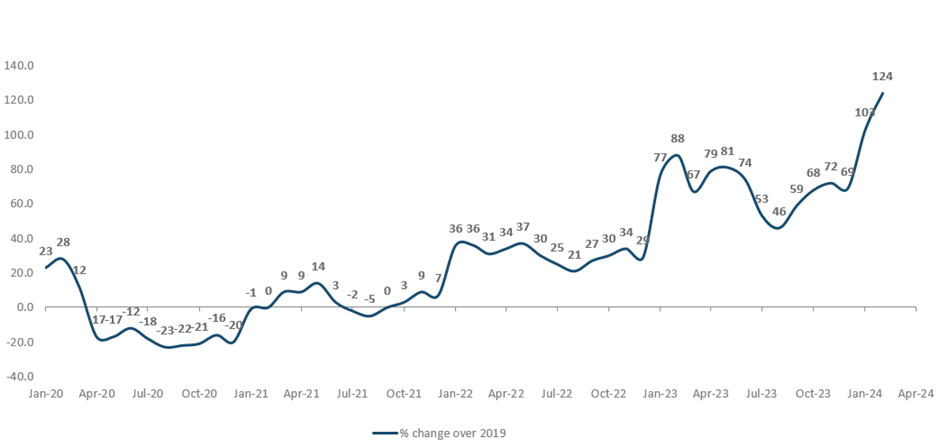

The alternate and short-term accommodation area is experiencing a much faster growth rate. We have seen demand grow by mid-to-high double digits from the same period in 2019. This has particularly benefited companies such as Airbnb, Bookings.com, and Expedia, which have higher focus in this category.

North America short-term rental volume relative to pre-pandemic from January 2020 to April 2024

Source: UNWTO Tourism Recovery Tracker; airdna.co ; April, 2024.

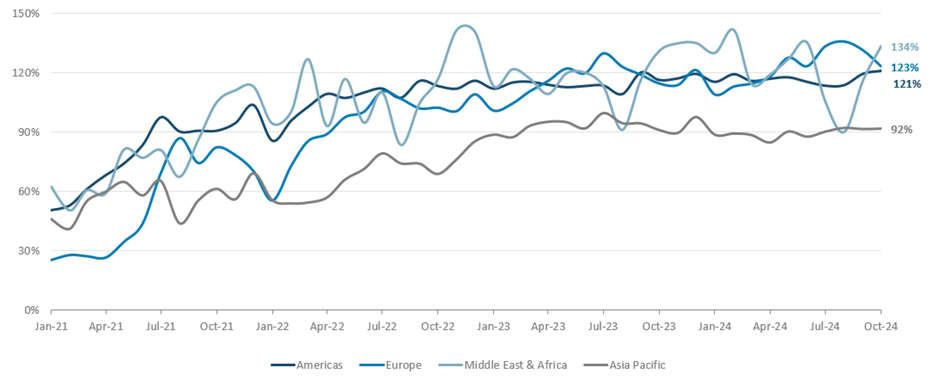

We have continued to see robust growth in revenue per available room (RevPAR) in hotels and resorts across regions. Once again, these companies are focused on growth in international markets going forward.

Hotel RevPAR by region as a % of same period in 2019

Source: J.P. Morgan – Lodging: International Monetary Trend Review; www.str.com ; October, 2024.

Cruise lines have also been in an attractive spot with demand growth for the next three to four years set to outpace supply growth. Companies in the cruise line space have been able to pursue higher pricing due to this factor. Indeed, most companies are seeing higher priced bookings for the next year at the same or above this years’ capacity. Companies are also seeing higher on-board spending, which should aid their margin growth going forward.

TRVI offers access to travel & leisure growth and high monthly dividends

Travel and leisure have long-term growth drivers that remain intact as we approach the midway point of this decade. These drivers have even accelerated in the post-pandemic period. From Gen-X, to Millennials, to Baby Boomers, these high population demographic cohorts are traveling in higher numbers and are spending more towards travel.

Most travel spending comes from the top 20% of income cohorts. That means the spending in this area is relatively immune to inflationary pressures. These factors, combined with companies’ focus on high margin premium and loyalty offerings, makes the sector attractive despite the short-to-medium term volatility.

The Harvest Travel & Leisure Index ETF (TRVL:TSX) has been designed to replicate, to the extent possible, the performance of the Solactive Travel & Leisure Index GTR, net of expenses.

TRVL Annualized Performance (%)

As at January 31, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | 3Y | 4Y | 5Y | SI |

|---|---|---|---|---|---|---|---|---|---|---|

| TRVL | (1.71) | 6.04 | 5.09 | (1.71) | 1.56 | 18.01 | 17.03 | 11.94 | 12.10 | 10.25 |

| TRVL.U | (0.92) | 9.23 | 6.94 | (0.92) | 8.40 | 17.26 | 16.13 | 10.03 | 10.70 | 8.87 |

Source: Harvest Portfolios Group, Inc.

TRVI offers investors the ability to mitigate some of the volatility in this sector, in favour of sacrificing some upside potential. This ETF offers a monthly cash dividend of $0.16 per unit.

TRVI Annualized Performance (%)

As at January 31, 2026

| Ticker | 1M | 3M | 6M | YTD | 1Y | 2Y | SI |

|---|---|---|---|---|---|---|---|

| TRVI | (1.29) | 6.90 | 5.58 | (1.29) | 2.04 | 11.94 | 13.85 |

Source: Harvest Portfolios Group, Inc.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The Funds are not guaranteed, their values change frequently, and past performance may not be repeated. The current yield represents an annualized amount that is comprised of 12 unchanged monthly cash distributions as a percentage of the closing market price of the ETF. The current yield does not represent historical returns of the ETF. Tax investment and all other decisions should be made with guidance from a qualified professional. The information is meant to provide general information for educational purposes. Any security mentioned herein is for illustration purposes and should not be taken as an invitation to purchase or sell such security.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.