By Ambrose O’Callaghan

Harvest has announced the launch of the Harvest Bitcoin Leaders Enhanced Income ETF (HBTE:CBOE) and the Harvest Bitcoin Enhanced Income ETF (HBIX:CBOE) on Wednesday, April 30, 2025. Michael Kovacs, Harvest ETFs President and CEO, recently sat down to discuss the launch of these new ETFs.

Q: Why are large corporations and businesses that have nothing to do with crypto or blockchain looking to build Bitcoin positions in their treasury?

A: The key reason for this accumulation is the potential of significant returns over the coming years. As demand for Bitcoin rises, corporations and businesses can benefit from what could be substantial gains in the value of the world’s premier digital asset.

Q: How could Bitcoin create value as a treasury holding in the years ahead?

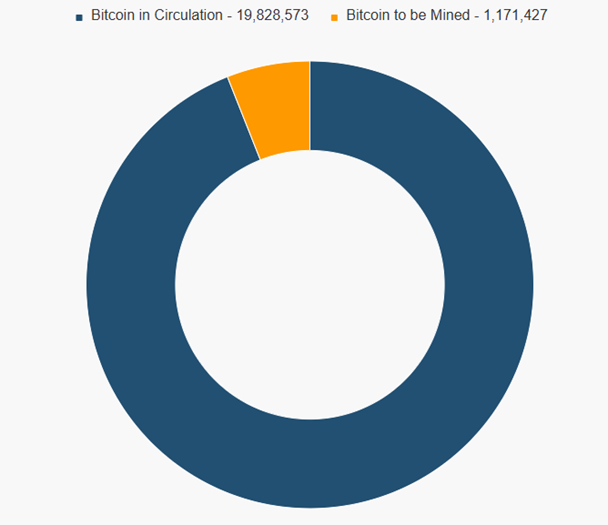

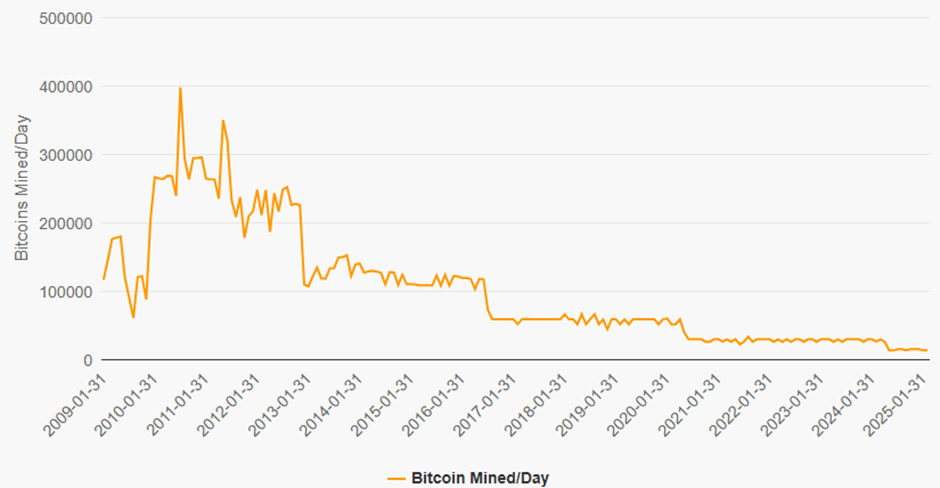

A: In 2009, when Bitcoin was first structured, it was designed as a digital asset on the original immutable blockchain. It required proof of completion of complex mathematical formulas to mine the coin. However, it was also set up with a limited amount of coins (21 million), and a limited amount that can be mined annually which halves every four years. 94% of Bitcoin is already in circulation, with 6% outstanding supply yet to be mined. The last Bitcoin will be mined in 2140.

Bitcoin in Circulation / Outstanding Supply

Source: HarvestETFs

Bitcoins Mined/Per Day

Source: HarvestETFs

Q: What is the Harvest Bitcoin Leaders Enhanced Income ETF?

A: The Harvest Bitcoin Leaders Enhanced Income ETF (HBTE:CBOE) allows us to focus on the top 15 publicly traded companies that are accumulating and storing Bitcoin in their treasuries or are investing in the Bitcoin ecosystem. These companies also have options available on their stock. That allows our portfolio management team to execute a covered call option writing strategy, while also employing modest leverage at approximately 25% to generate high levels of monthly income and growth potential.

Q: What is the Harvest Bitcoin Enhanced Income ETF? How does it differentiate from HBTE?

A: The Harvest Bitcoin Enhanced Income ETF (HBIX:CBOE) holds shares of the iShares Bitcoin Trust ETF at launch. Going forward, HBIX will invest all its assets in one or more ETFs that provide exposure to the movement of the price of Bitcoin. This portfolio is also overlaid with an active covered call writing strategy, while employing modest leverage at approximately 25% to generate high monthly cash distributions and growth potential.

Q: Why did you decide to launch on the Cboe Canada exchange?

A: Harvest ETFs decided to launch its first two Bitcoin ETFs with Cboe Canada to gain access to its next generation capital raising and liquidity solutions. Moreover, we were attracted to their outstanding client service that has made this partnership a smooth one ahead of this exciting product launch.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.