By Ambrose O’Callaghan

The passing of three important pieces of legislation in 2021 and 2022 thrust the United States manufacturing sector, and industrials, into the spotlight. But what are industrials, anyway? When we are talking about industrials, we are referring to a sector that is composed of companies that produce goods used in construction and manufacturing that encapsulates several sub-sectors.

Some of the most prominent sub-sectors in the Industrials space include Aerospace & Defense, Electrical Components & Equipment, Industrial Machinery & Supplies & Components, Rail Transportation, and others. The Industrials sector is drawing attention in 2024 for several key reasons.

Today, we are going to explore the resurgence in US manufacturing, the burgeoning aerospace and defense space, and the merits of Harvest’s first-ever covered call Industrials ETF. Let’s jump in.

The resurgence in US manufacturing

According to the U.S. Department of the Treasury, real manufacturing construction spending has doubled since the end of 2021. This increase occurred in a supportive policy climate after the passing of three key pieces of legislation: The Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and CHIPS Act. These three pieces of legislation provided funding and tax incentives for public and private entities in the manufacturing construction space.

The U.S. Treasury Department report shows that the computer/electronic segment has represented the largest component of the U.S. manufacturing resurgence. However, the growth in the size of that segment has not been offset by a reduction in spending in other manufacturing sub-sectors. Construction in areas like chemical, transportation, and food/beverage have all enjoyed growth through 2022, just at a reduced pace. The chart below shows the top manufacturing construction projects by value and location since August 2022.

Manufacturing Construction Surges Across U.S.

Top projects by value and location since August 2022

Map: Sebastian Obando/Construction Dive

The CHIPS and Science Act was signed into law by President Joe Biden on August 9, 2022. It included US$39 billion in subsidies for chip manufacturing on U.S. soil. This included 25% investment tax credits for the cost of manufacturing equipment. The chart below shows construction spending in the manufacturing space over the past two decades, bookended by a surge after three pieces of legislation.

Construction Spending: Manufacturing

Source: U.S. Census Bureau, retrieved via FRED, Federal Reserve Board of St. Louis, Harvest ETFs, latest available as of June 12, 2024.

Deutsche Bank research indicated that 18 new chipmaking facilities began construction between 2021 and 2023. Indeed, the Semiconductor Industry Association reported that over 50 new semiconductor ecosystem projects have been announced after the CHIPS Act.

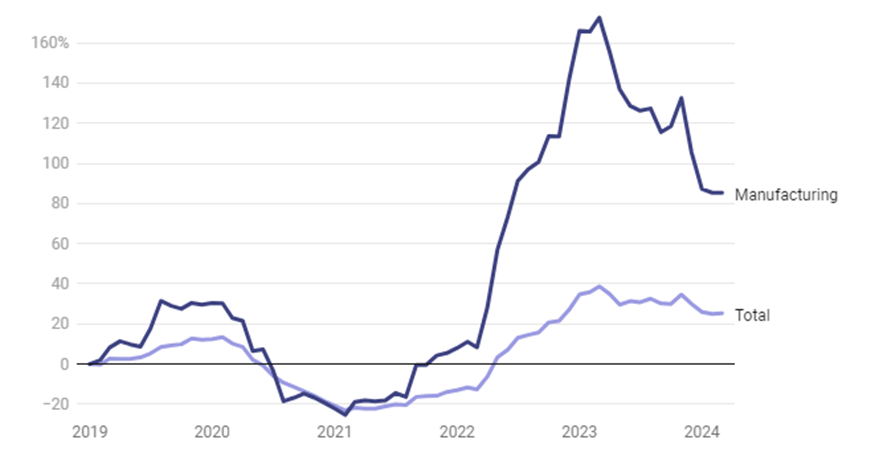

Manufacturing Activity Skyrockets on the Heels of 2022’s CHIPS Act

Percent change in construction starts since January 2019, seasonally adjusted dollars

Chart: Sebastian Obando/Construction Dive. Source: ConstructConnect.

Aerospace and defense spending today

The aerospace sector involves the design, manufacture, and operation of vehicles that travel in aerospace. Meanwhile, the defense sub-sector produces and seeks to sell weapons, and military technology.

Political scientists attempt to measure geopolitical risk by charting the Geopolitical Risk (GRP) Index. The Russian invasion of Ukraine in 2022 saw the GPR rise to its highest level since the Iraq invasion of 2003. European powers like Germany have responded by pledging to significantly increase defense spending.

According to the Stockholm International Peace Research Institute (SIPRI), global military expenditure rose to an all-time high of US$2.44 trillion in 2023. That represented the largest year-over-year increase on weapons spending since 2009 at a 6.8% compound annual growth rate (CAGR).

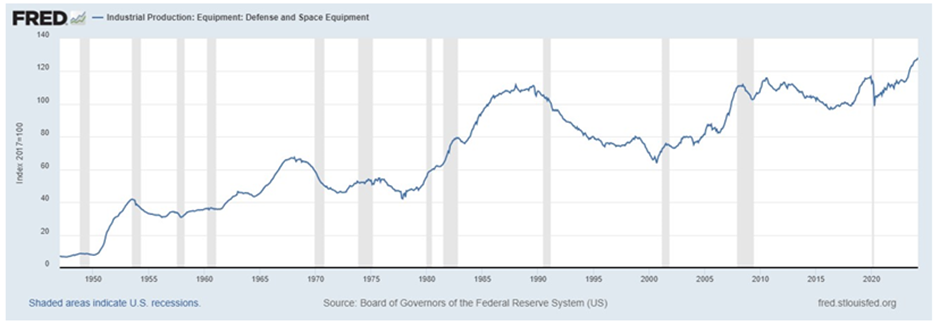

The chart below illustrates the industrial production rate for equipment in defense and the space sector. Following the last three recessions, we have seen increased spending.

HIND: An Industrials ETF with high monthly income

The Harvest Industrial Leaders Income ETF (HIND:TSX), which was launched on April 15, 2024, offers investors access to a portfolio of leading industrial companies and emerging trends. Some of the largest sub-sectors represented include Aerospace & Defense, Electrical Components & Equipment, Industrial Machinery & Supplies & Components, and Rail Transportation.

HIND is overlayed with an active covered call writing strategy to generate consistent and high income every month. This ETF has paid out a monthly cash distribution of $0.0700 per unit in both payment months following its TSX debut.

Investors who are hungry for access to the surging US manufacturing space, the repatriation of semiconductor production in North America, and an aerospace & defense sector benefiting from geopolitical shifts, combined with high monthly income from covered calls, may want to consider HIND today.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article is to inform and educate and therefore should not be taken as investment, tax, or financial advice.