By Paul MacDonald

Investing over the long-term means weathering economic and market cycles. While history has shown us that stock markets grow on aggregate over time, short-term market downturns and recessionary periods can impact portfolios. That’s why many Canadian investors consider exposure to sectors and companies that are well positioned for a recessionary period.

At Harvest ETFs we believe that the US Healthcare Sector has many of the characteristics that investors seek during a recession. To demonstrate that we will show how markets tend to behave before and during an economic recession, before highlighting the characteristics of the healthcare sector and specific healthcare stocks that can serve investors in these periods.

Investing during a recession

Recessions are often difficult to quantify and identify while they’re happening. Typically, when we look at the US economy, the technical definition is two quarters of negative GDP growth. However, the official declaration of a recession may only come months after those two quarters have ended, or even when growth has resumed. In fact, the National Bureau of Economic research notes that it can take up to 21 months from when the recession has started until it is declared that a recession has started.

Stock markets, however, tend to be forward-looking. Therefore, fear and speculation about a recession can impact stock markets before a recession is officially announced.

From an investor’s perspective, recessions come with a mixture of risk, uncertainty, and opportunity. Put simply, recessions usually come with slowdowns in consumer & business spending, as well as investment into the economy. That slowdown causes disproportionate impacts to different sectors. Companies and sectors considered to have a high degree of their valuation coming from expected growth that is far into the future, or those that are highly correlated to economic activity —meaning the possibility of a company’s success is unclear—are typically the hardest hit, as are companies that rely on consumers’ discretionary spending. When the economy gets worse and individuals lose jobs, they tend to spend less.

Conversely, the industries and companies that can survive and thrive in a recession tend to have significant scale, robust balance sheets, stable sources of demand and what’s called “visibility into earnings.”

Visibility into earnings means that investors and analysts can relatively safely predict what a company will report on their earnings each quarter. Companies with stable sources of demand for their products tend to have greater visibility into earnings, while more speculative companies tend to have less visibility.

One of those sectors that can often grow and lead markets during recessionary periods is healthcare.

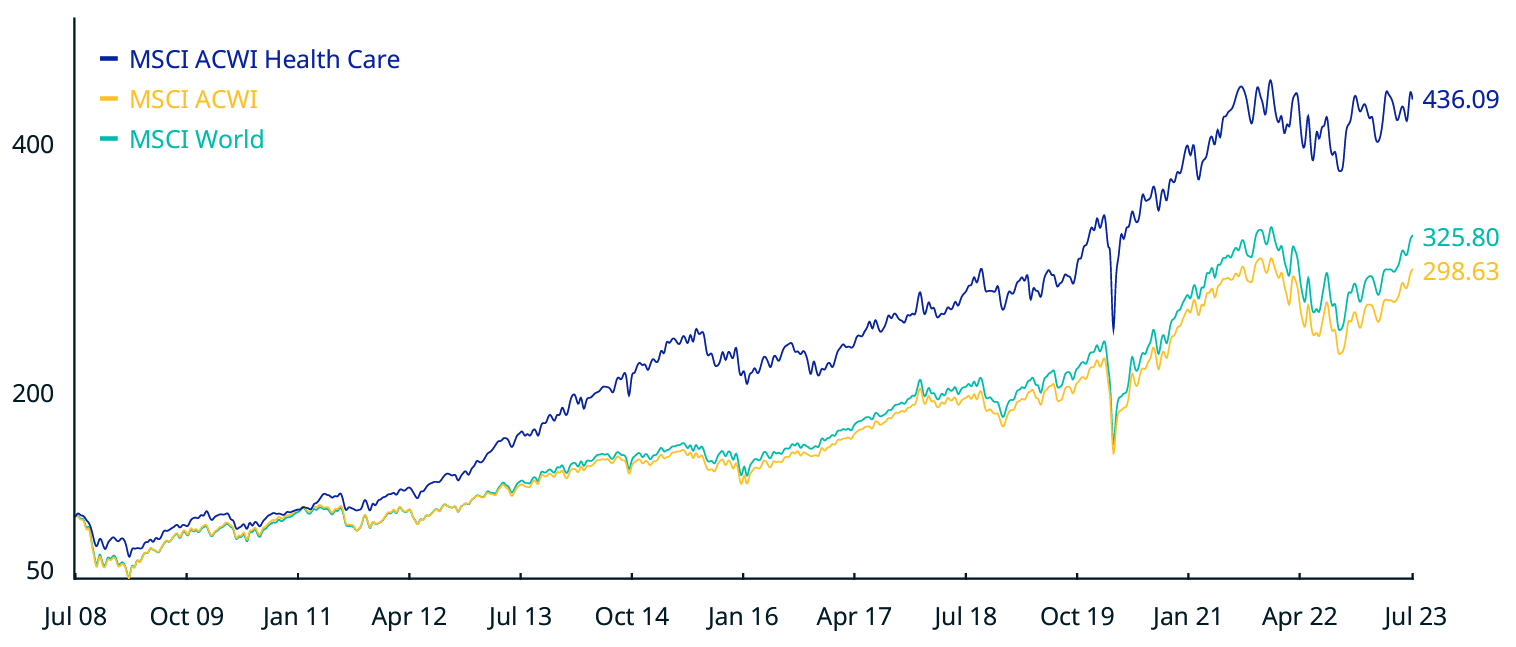

CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD)

(July 2008 – July 2023)

Source: MSCI ACWI Health Care Index Factsheet

How healthcare tends to perform during recessions

The large capitalization US Healthcare sector is often sought as a relative safe haven during periods of recession or uncertainty when investors don’t want to add additional risk to their portfolios. At the most fundamental level that’s because Healthcare is a superior good.

Superior goods are the goods that consumers and businesses continue to spend on no matter their economic or financial circumstances. If someone loses their job, they might not buy a new laptop but they will continue to buy food, clothes, and medications. Healthcare is an excellent example of a superior good, which is some of why the US healthcare sector has shown relatively consistent market value growth trends over time without many significant peaks and valleys.

Not only is the demand for healthcare stable, it’s growing steadily thanks to non-cyclical forces. The developed world is getting older, with average ages in North America and Europe increasing steadily and forecast to increase over the coming years. As individuals age they spend more on healthcare, regardless of the economic cycle we happen to be in.

Investors also seek companies with scale during recessions. Large companies with significant cash reserves are more insulated from short-term economic cycles. They typically have diversified lines of business or even competitive moats—characteristics that make disruption by a new competitor more difficult. These traits are all attractive to investors in a recession as they imply less uncertainty.

Healthcare companies also innovate, developing new drugs, medical devices, and technologies designed to deliver better patient outcomes. Those innovations can drive some significant growth opportunities for the sector during periods of economic growth as well as in economic contractions.

Put simply, during a recession investors look for sectors and companies with relatively stable sources of earnings, scale, and less uncertainty. The healthcare sector delivers all of that.

How Canadian Investors can access the healthcare sector

The world’s largest healthcare companies, and best-established healthcare stocks, are based in the United States. Canadian investors seeking broad-based exposure to the US healthcare sector can achieve that through a healthcare ETF.

The Harvest Healthcare Leaders Income ETF (HHL:TSX) offers Canadian investors access to a diversified portfolio of 20 large-cap healthcare companies. These companies have a combined market capitalization that is multiple times larger than the entire TSX—demonstrating the scale that many investors seek in their recession-resistant investments. Moreover, the portfolio is diversified across a range of subsectors which can help offset any short-term cyclical downturns in a single stock or subsector.

In addition to its portfolio of large-cap healthcare companies, HHL also pays a monthly income distribution to unitholders. That distribution is generated through a combination of dividends from underlying stocks and premiums from the sale of covered call options. That income can be particularly helpful in a recessionary period, offsetting some potential short-term loss in value, providing cashflow that can help meet lifestyle needs, or being reinvested into the stock market for additional resilience or recovery in the face of a recession.

The prospect of a recession can make some investors nervous. However, focusing on companies with scale, sectors with stable demand, and strategies that have weathered past periods of economic downturn can help investors deal with these moments. We believe that the healthcare sector, as captured by the HHL ETF, offers these attractive traits for recession resilience while still offering growth opportunities as the economy recovers.

Paul MacDonald

Paul MacDonald is the Chief Investment Officer and Portfolio Manager at Harvest ETFs. He has over 20 years investment management experience and currently leads the Harvest investment team. He oversees all of Harvest’s ETF strategies, leads Harvest’s covered call options trading, and plays a key role in new product development. He is considered an industry expert on call options strategies and the Healthcare sector, with regular media appearances on BNN Bloomberg and in the Globe & Mail.