By Ambrose O’Callaghan

Harvest ETFs has built on its reputation in delivering monthly income to its unitholders through writing call options on portfolios with high quality companies in leading businesses. What is behind Harvest’s foray into the world of Bitcoin? It comes down to betting on what the future holds for this promising asset.

Why businesses are buying Bitcoin

In recent years, we have seen a trend of large corporations accumulating Bitcoin and investing in the Bitcoin ecosystem. Why would a company that runs a business unrelated to digital currencies accumulate and build Bitcoin in their treasury? Or, alternatively, invest substantially in the Bitcoin ecosystem?

The Bitcoin Ecosystem

Source: Harvest Portfolios Group, Inc.

The key reason is the potential of significant returns over the coming years. As demand for Bitcoin has climbed, corporations are positioned to benefit from what could be substantial gains in the value of the world’s premier digital asset.

Over the last 4-5 years, Bitcoin has become the widely accepted crypto asset for building a reserve for longer term accumulation. This is true among corporations, sovereign wealth funds, exchange-traded funds (ETFs), hedge funds, smart contracts, as well as individual investors and other entities.

When Bitcoin was first structured in 2009, it was designed as a digital asset on the original immutable blockchain. The blockchain required proof of completion of complex mathematical formulas to mine the coin. It was also set up with a limited about of coins – 21 million – and a limited amount that can be mined annually. That amount halves every four years. This limits the amount of new Bitcoin available for mining, creating scarcity.

This was one of the defining features that Satoshi Nakamoto, the anonymous founder of Bitcoin, set up at the outset. That feature was designed to make Bitcoin anti-inflationary, as opposed to fiat currency. So far, this strategy has been successful. Bitcoin’s inflation rate stood at 1.7% in December 2024.

A corporation that has excess cashflow from earnings, or the ability to raise capital on reasonable terms, is likely looking at the long-term value of this digital asset. That moves some businesses to accumulate Bitcoin based on models that show limited supply and increasing long-term values for Bitcoin.

The institutional acceptance of Bitcoin

Bitcoin first became a household name in its bull run of 2017. That year saw the digital currency rise from a US$1,000 valuation to as much as US$20,000 by the end of the year. It corrected sharply in early 2018, but the bull market established Bitcoin as an alternative asset to watch in the years to come.

The 2020s have seen Bitcoin rise to new price heights and to new levels of institutional acceptance. A major milestone occurred in January 2024, when the Securities and Exchange Commission (SEC) chair Gary Gensler penned a statement on the approval of spot Bitcoin ETF products. This resulted in an explosion of Bitcoin ETF products on US exchanges, and saw many billions raised in the days, weeks, and months that followed.

In 2025, the new U.S. administration declared that it would establish a Bitcoin strategic reserve. As a minable asset Bitcoin decreases and eventually ceases, no one really knows what the figure will be. The consensus is that it will be much higher than it is today, as it trades between the US$80-100k mark at the time of this writing.

New Harvest Bitcoin Income ETFs

Seeking to respond to this new paradigm, Harvest has launched two new Bitcoin-focused exchange-traded funds.

The Harvest Bitcoin Leaders Enhanced Income ETF (HBTE:CBOE) holds top companies that are accumulating, storing, or investing in the Bitcoin ecosystem. These 15 companies derive value from either directly holding Bitcoin, mining Bitcoin, or by providing services to customers interested in transacting or holding Bitcoin.

HBTE overlays an active covered call option writing strategy to to support its monthly cash distributions. It employs modest leverage at 25% to enhance monthly income and growth potential.

The Harvest Bitcoin Enhanced Income ETF (HBIX:CBOE) invests all its assets in one or more ETFs that provide exposure to the movement of the price of Bitcoin, the world’s premier digital currency. Initially, HBIX will invest all its assets in IBIT (iShares Bitcoin Trust ETF) with option to invest in other similar products overtime. The portfolio is overlaid with an active covered call writing strategy, while employing modest leverage at approximately 25% aiming to generate high levels of monthly income and growth potential.

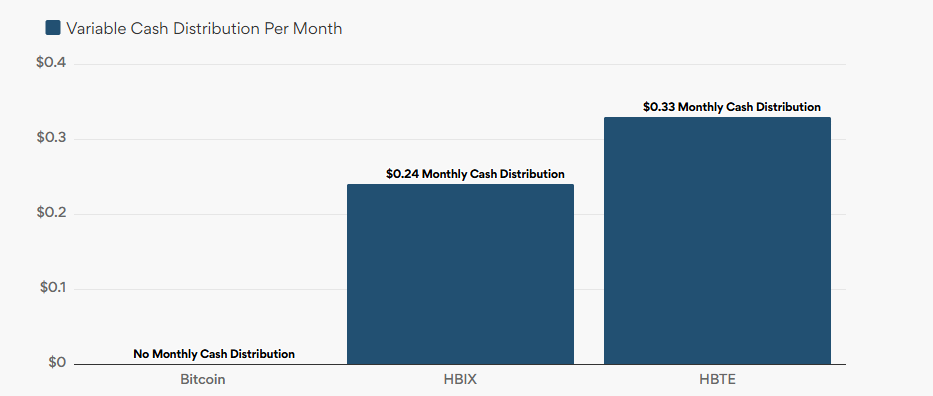

Bitcoin Exposure with Monthly Income*

Source: Harvest Portfolios Group Inc.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. The content of this article is to inform and educate and therefore should not be taken as investment, tax, or financial advice.

*Bitcoin is a digital currency that pays zero income. HBTE holds 15 companies in the Bitcoin ecosystem with positive correlations to the price of Bitcoin. Using modest leverage combined with a covered call strategy, HBTE can generate high levels of monthly income from exposure to the Bitcoin ecosystem.