By Ambrose O’Callaghan

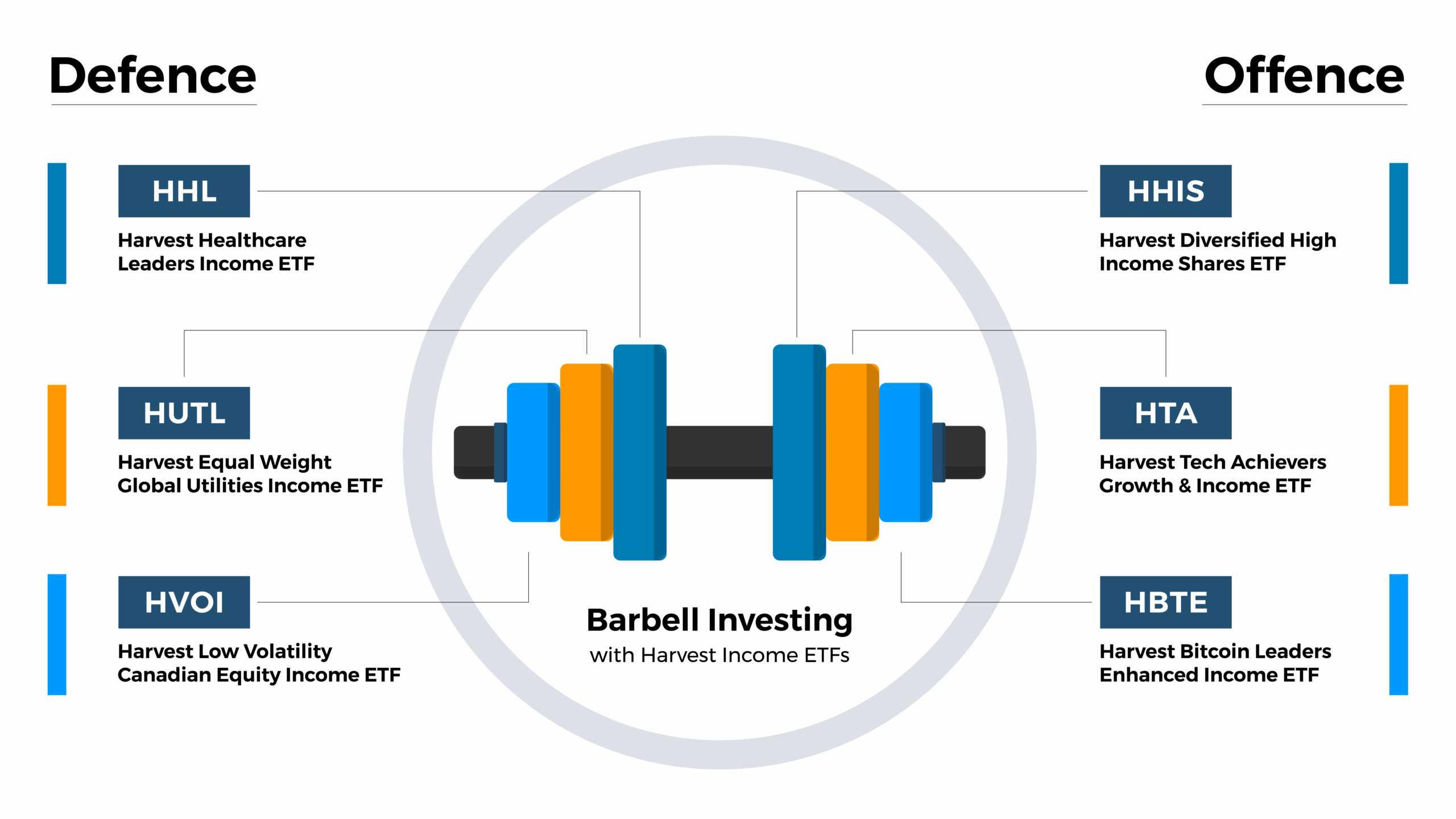

Back in December 2023, we looked at how a barbell bond strategy works. In this piece, we will explore the barbell investing strategy from a different perspective. Conceptually, this investment strategy seeks to strike a balance between risk and reward by investing in high-growth “risk-on” assets, and defensive “risk-off” assets. By accessing the benefits of both “extremes”, this strategy aims to achieve balanced capital gains.

Today, we will review the barbell strategy using six Harvest ETFs on each end. Three defensive-oriented ETFs that also provide access to monthly cashflow through an active covered call option strategy, and three “risk-on” ETFs that offer exposure to growth-oriented areas, while also delivering consistent cashflow every month.

Reducing Risk | Defensive Income ETFs

HHL | Healthcare exposure plus monthly income

In August, we provided an overview of the healthcare space and how it has impacted the Harvest Healthcare Leaders Income ETF (TSX: HHL), Canada’s largest healthcare ETF. To reiterate; the health care sector has shown both defensive and growth-oriented qualities through its history. Healthcare is defensive due to the essential nature of it services, whereas its growth qualities stem from the high demand for specialized products as well as technological innovations.

Healthcare equities have faced challenges in North American and global markets through the first three quarters of 2025. As we highlighted in our recent monthly commentary, valuations have been compressed relative to the market and investors have looked for catalysts for a rebound in this climate. To that end, it is worth highlighting some stock-specific catalysts that are starting to surface.

Those catalysts have included Warren Buffett’s UnitedHealth purchase and headlines focused on the issue of reshoring and repatriation. More stock-specific catalysts have included some positive earnings released across select names. The most recent examples came in the form of Intuitive Surgical Inc., which jumped double-digits on the back of an improved medical devices market and large capitalization biopharmaceutical innovator Regeneron Pharmaceuticals that posted strong returns following an upbeat quarter. Compared to previous quarters when strong earnings went virtually un-noticed by the markets, seeing strong stock performance matching the strong reported earnings is perhaps a more subtle sign that sentiment has stabilized in the sector.

HHL offers exposure to a defensive sector that also has growth qualities. The portfolio is composed of 20 large-cap US healthcare stocks, overlayed with an active covered call option writing strategy to generate high levels of monthly income. Indeed, HHL has delivered income every month for over a decade since its inception.

HUTL | Why utilities right now?

Utilities have long been regarded as a mainstay for those seeking stability, income, and defensive positioning in their portfolios. However, rising power demand, technological progress, policy shifts, and the ongoing global energy transition has made utilities a unique target for those who also want growth qualities. The Harvest Equal Weight Global Utilities Income ETF (TSX: HUTL) offers unique advantages as a utilities ETF, due to its global reach and its income generation.

HUTL | Benefits of utilities and steady income

Essential services with stable cash flows

Utilities deliver critical services like electricity, gas, water, and telecommunication, that are largely immune to economic cycles. Because of this, utilities are a stable source of revenue and cashflow.

Power demand growth

Electricity demand has soared in recent years and is set to increase at an even greater rate due to the proliferation of data centres and a broad electrification push. Data centres consumed roughly 1.5% of global electricity in 2024, a rate that could double by 2030. Goldman Sachs estimates that data centre power demand will grow by 165% by 2030.

Energy transition & infrastructure spending

Clean energy investment is projected to reach $2.2 trillion this year, more than double fossil fuel investment. HUTL offers exposure to leaders in this space, including VERBUND AG, Endesa, Fortum, Brookfield Renewable, and others. Meanwhile, the IEA forecasts that $450 billion will go into solar investment in 2025, with additional spending in grid and storage spending.

Diversification and the global advantage

Utilities are critical, but these companies also face risks from climate events and changing regulatory policy. HUTL’s global equal-weighted portfolio means that utilities exposure is spread across regions, reducing concentration risk. This helps to mitigate that regulatory risk as well as geographic challenges like storms, wildfires, and a changing political landscape.

Income generation and lower volatility

HUTL utilities Harvest’s active covered call option writing strategy to generate option premiums, which also serves to reduce portfolio volatility. Meanwhile, the utilities sector has historically outperformed during turbulent market periods. This is an added benefit in an uncertain market.

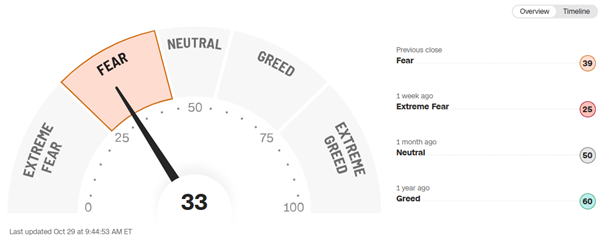

HVOI | A low volatility strategy with monthly income

In April, broader markets were reeling from the uncertainty that emerged in the wake of the “Liberation Day” tariff announcement. Markets have calmed in the months that followed, with the US administration rolling back significantly on the high tariffs it originally had promised. That said, the CNN Fear and Greed Index shows that investors remain concerned at this late stage in 2025.

CNN Fear & Greed Index

Source: CNN.com, Fear & Greed Index, October 29, 2025.

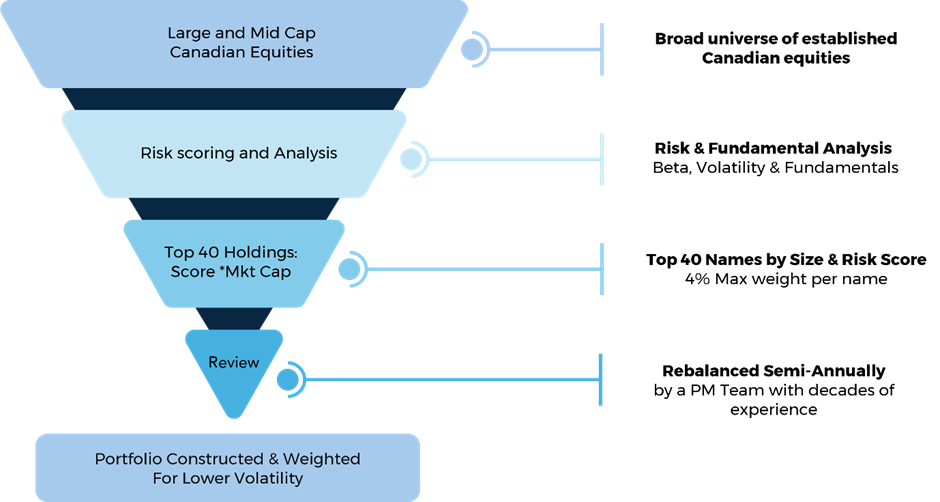

Harvest launched the Harvest Low Volatility Canadian Equity Income ETF (TSX: HVOI) in April 2025. This ETF holds 40 top Canadian equities, which are ranked and weighted by their risk score and market cap weight, with a 4% maximum weight per name. The equities are scored according to risk and fundamental metrics.

Low Volatility | Portfolio Construction

Source: Harvest Portfolios Group, Inc. April 2025.

Benefits of HVOI

- Access to rules-based portfolio that manages risk

- Covered call strategy to generate monthly cashflow and lower volatility

- Flexibility to employ cash-secured puts to generate additional income

- Rules-based and disciplined portfolio construction process

Pressing Offense | 3 Growth-Oriented Income ETFs

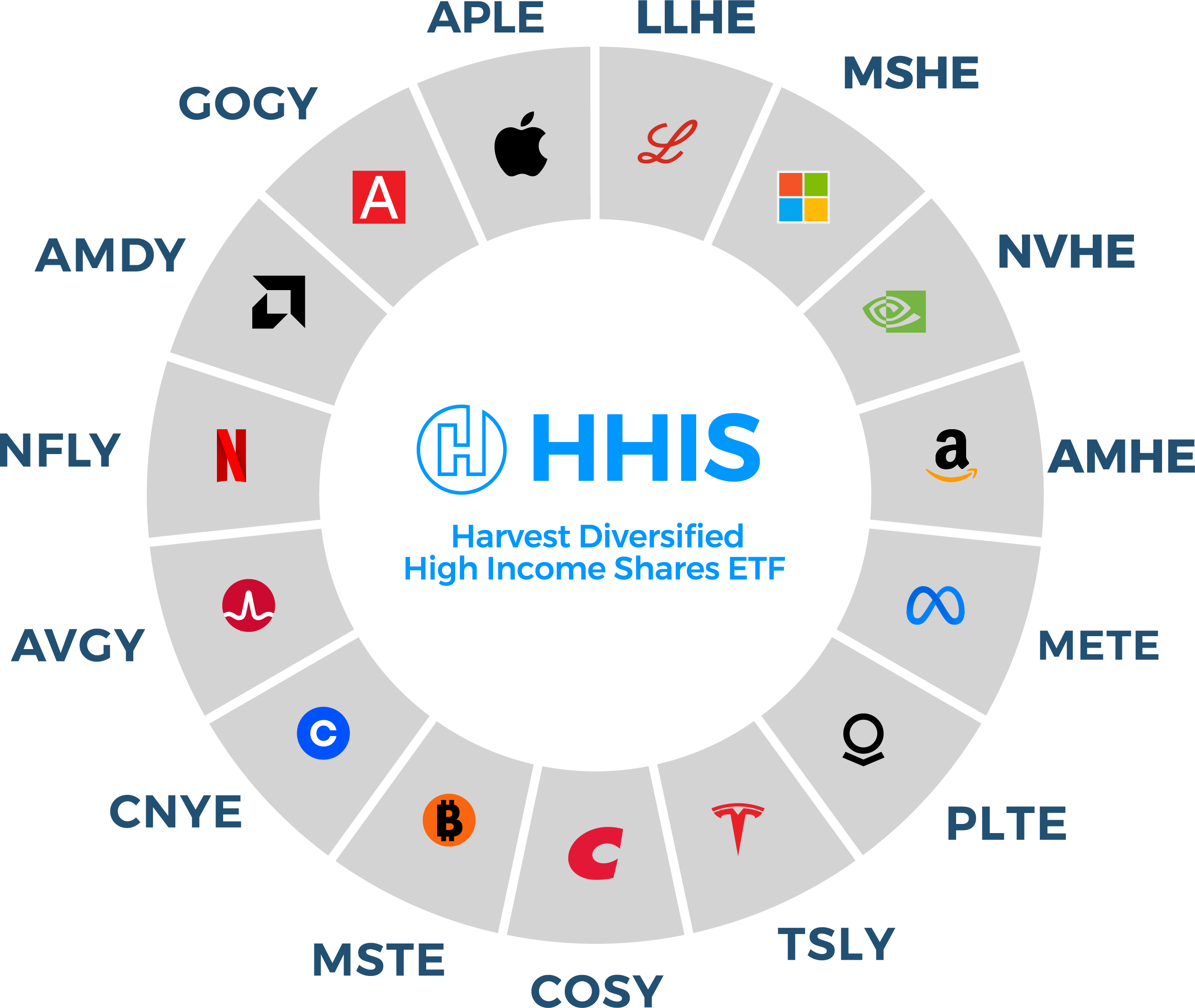

HHIS | One ETF with top US stocks built for a high monthly yield

In August 2024, Harvest ETFs launched the Harvest High Income Shares™ ETF suite. High Income Shares™ are single stock ETFs that offer exposure to top companies in both the United States and Canada. The ETFs are overlaid with an active covered call writing strategy, seeking to generate high monthly income. Harvest High Income Shares™ have reached above $3 billion in total AUM since inception at the time of this publication.

This past January, we expanded the High Income Shares suite and launched the Harvest Diversified High Income Shares ETF (TSX: HHIS). HHIS is a diversified, all-in-one ETF that combines several Harvest single stock ETFs into one portfolio. Each invests, on a levered basis, in a leading U.S. company positioned for strong growth. The ETF is built to deliver high monthly income while capturing those growth opportunities, with the added benefit of diversified exposure.

These U.S. companies are some of the largest in the public domain. Their aggregate market capitalization represents over $25 trillion. That is several times larger than the size of the entire S&P/TSX Composite Index. This gulf in size and scale illustrates how the global reach of companies in the High Income Shares suite dwarfs the Canadian market.

Market Capitalization of HHIS Underlying Stocks vs S&P/TSX Composite Index

Source: Harvest ETFs, Bloomberg as at October 29, 2025. Illustration of the total consolidated market capitalization of the stocks that are represented within the Harvest Diversified High income Shares ETF versus the total index value of the S&P/TSX Composite Index.

Source: Harvest Portfolios Group, Inc. September 30, 2025.

HTA | Dominant players in an innovation-led mega sector

The Harvest Tech Achievers Growth & Income ETF (TSX: HTA) is an equal weight portfolio of 20 large-cap technology companies. At the time of this publication, that includes big players in the artificial intelligence space. Apple, NVIDIA, Meta Platforms, Alphabet, Microsoft, and others are a part of HTA’s portfolio.

Earlier this month, we’d highlighted the impacts that AI is having on the broader tech space. Indeed, a report from S&P Global this past summer estimated that the generative AI market could deliver revenue growth at a 40% compound annual growth rate (CAGR) from 2024 through to 2029. That growth has been heavily concentrated in North America, with the same report stating that “63% of 2024 revenue attributed to AI providers” were based in North America.

This ETF is overlayed with an active covered call writing strategy to generate monthly cashflow. HTA has raised its monthly distribution five times since its inception. It last paid out a monthly cash distribution of $0.14 per unit. That represents an 8.35% current yield as at October 27, 2025.

HBTE | The Bitcoin ecosystem and Harvest’s income generation

The Harvest Bitcoin Leaders Enhanced Income ETF (CBOE: HBTE) holds top companies within the Bitcoin cryptocurrency ecosystem. Companies that exist within the Bitcoin ecosystem include Bitcoin Treasury holders, Digital Asset Management & Institutional Services, Bitcoin miners, and Trading & Wallets platforms.

This recent piece goes into greater detail for each of these components. The HBTE holding MicroStrategy – recently rebranded as Strategy – is an example of a Bitcoin Treasury company. It has steadily increased its Bitcoin holdings since its first acquisition in 2020, now holding over 640,000 bitcoins valued at over USD$71 billion as at October 29, 2025.

HBTE also offers access to companies like Galaxy Digital that exist in the Digital Asset Management & Institutional Services arena, Bitcoin miners like Riot Platforms and Hut 8 Mining, and Trading & Wallets platforms like Coinbase.

HBTE last paid out a monthly cash distribution of $0.33 per unit. It has delivered the same monthly cash distribution for five consecutive months since its inception.

The Harvest Barbell | Balance & Monthly Income

The Harvest Barbell Investing Strategy | Visualized

Harvest Income ETFs allow investors to utilize the barbell investing strategy, while also earning steady, predictable monthly income.

On the defensive side, investors can get exposure to healthcare through HHL, utilities through HUTL, and a broader low volatility portfolio with HVOI.

On the offensive side, HHIS delivers access to dominant US companies in areas like technology, retail, and mass media. There is also technology through HTA – a three-time Lipper award winner, and investors can access the Bitcoin ecosystem with monthly income through HBTE.

Disclaimer

This article is meant to provide general information for educational purposes. Any security mentioned herein is for illustration purposes and should not be taken as an invitation to purchase or sell such security. The content in this article should not be construed as investment advice. Certain statements contained herein are based on information believed to be reliable. Where such information is based, in whole or in part, on data provided by third parties, Harvest ETFs cannot guarantee that it is accurate, complete, or current at all times.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax, investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.