The barbell strategy is a fixed income investment strategy where the investor only buys short-term and long-term bonds. Downside risk is the financial risks associated with the loss on an investment. The barbell bond investment strategy aims to reduce downside risk while still having exposure to higher-yield, long-term bonds. Today, I want to explore the intricacies of this strategy. We will aim to gain a deeper understanding of the barbell bond strategy and discuss who should employ it.

How does a barbell bond strategy work?

Cash and fixed income markets offered unattractive returns after the 2007-2009 Great Recession. The Federal Reserve, Bank of Canada, and central banks across the developed world moved to significantly reduce interest rates to promote economic growth. That strategy, combined with multiple rounds of quantitative easing in the United States, Europe, and elsewhere, provided a boost for equity markets through the 2010s. Now, with central banks hiking interest rates in response to soaring inflation after the COVID-19 pandemic, fixed income products have fallen back into favour among many investors.

A barbell strategy involves owning bonds with shorter and longer durations. Duration measures how bond values respond to interest rate changes. Generally, bond values and interest rates changes are inversely related and longer-term bonds are more sensitive to these changes compared to shorter term bonds. As interest rates rise, investors will typically prefer the lower fixed interest rate paid by a bond. The result is a decline in the bond’s price. The strategy often focuses on the very short term and long terms of the maturity spectrum. The resulting portfolio shape resembles a barbell, with short-term and long-term bonds at either end.

Understanding the barbell bond strategy

The short end of the barbell is typically occupied by short-term bonds. These have maturities ranging from a few months to a few years. These bonds offer investors stability and liquidity. Short-term bonds are less sensitive to interest rate fluctuations. That makes them a reliable choice for capital preservation. Moreover, the shorter duration of these investment vehicles reduces exposure to market volatility. Ideally, this provides a cushion against sudden economic downturns.

Investors may seek out short-term bonds if they are prioritizing capital preservation in the near term. That may be in the form of a planned expense or to jump on an investment opportunity, like the purchase of a new home. Targeting short-term bonds gives investors a greater chance at maintaining liquidity for such a scenario.

Meanwhile, on the other end of the barbell spectrum are long-term bonds. These bring a different set of advantages to the barbell strategy. These bonds usually have maturities that extend beyond ten years. That means that these fixed income vehicles are more sensitive to interest rate fluctuations over their short-term counterparts.

Often yields are higher for longer term bonds. However, in the current interest rate environment, they are lower than shorter term rates. That suggests that the market may think interest rates over time will need to come down. Owning the longer-term bond generally allows investors to take advantage of higher interest rates and usually ensures a known cash flow amount over a longer period. This known cash flow and generally higher interest for longer periods are not characteristics of shorter-term bonds. Moreover, long-term bonds can act as a diversification tool since their performance may not be exactly correlated with short-term bonds.

In a nutshell, the barbell bond investment strategy aims to take advantage of the benefits of stability and liquidity from short-term bonds, coupled with the pursuit of locking in known rates over the longer term from longer term bonds.

Who should look to employ the barbell bond strategy?

A barbell strategy is often utilized by investors when looking to ensure some shorter-term stability while ensuring predictability in cash flows for investors who have locked up their principal for the longer period.

Investors who are hungry for stability and liquidity but want more certainty over longer term cash flow may choose to employ the barbell bond strategy. As stated, short-term bonds will provide the desired stability and liquidity in the near term while the inclusion of long-term bonds will enable those same risk-averse investors to take advantage of higher long-term rates. Ideally, this allows more defensive investors to preserve capital and take advantage of the diversification and more certainty from longer term cash flows that long-term bond inclusion implies.

Investors who want income may also be attracted to the barbell bond investment strategy with a covered call strategy. After all, the inclusion of long-term bonds enables this type of investor to take advantage of higher cash flows from the covered calls that are not offered currently in other longer -duration fixed income vehicles.

Finally, investors who prioritize diversification beyond traditional strategies may find the barbell bond strategy attractive. Since this strategy aims to capture the benefits of both short-term and long-term bonds, it provides diversification. That comes in the form of stability and liquidity from the short-term bond end and higher yields from the long-term covered call bond end. That diversification has the potential to enhance risk-adjusted returns and mitigate the impact of certain adverse market conditions.

What are the ideal market conditions for the barbell bond strategy?

The yield curve is a representation of the yield that is being offered on bonds across different maturities over time. It plays a crucial role in the barbell bond strategy.

What are the key takeaways and considerations?

The barbell strategy seeks to take advantage of the stability and liquidity offered by short-term bonds, while also benefiting from the higher yields of longer-duration bonds. With investments on bother end or the maturity spectrum and none in the middle this conjures up the image of a barbell, hence the name. Of course, there are risks involved with this investment strategy just like any other.

As always, interest rate risk remains a concern even with investors diversifying with short-term and long-term bonds. If investors purchase long-term bonds when interest rates are low, they may end up with bonds that will lose value in an interest rate tightening environment. The barbell bond strategy lacks exposure to medium-term bonds. Historically, these bonds offer attractive returns relative to short-term bonds. Medium-term bonds also offer only slightly lower returns than long-term bonds.

For investors that aim to build a barbell bond portfolio or purchase an exchange-traded fund (ETF) that employs the strategy, educating oneself on its benefits and risks is always advisable.

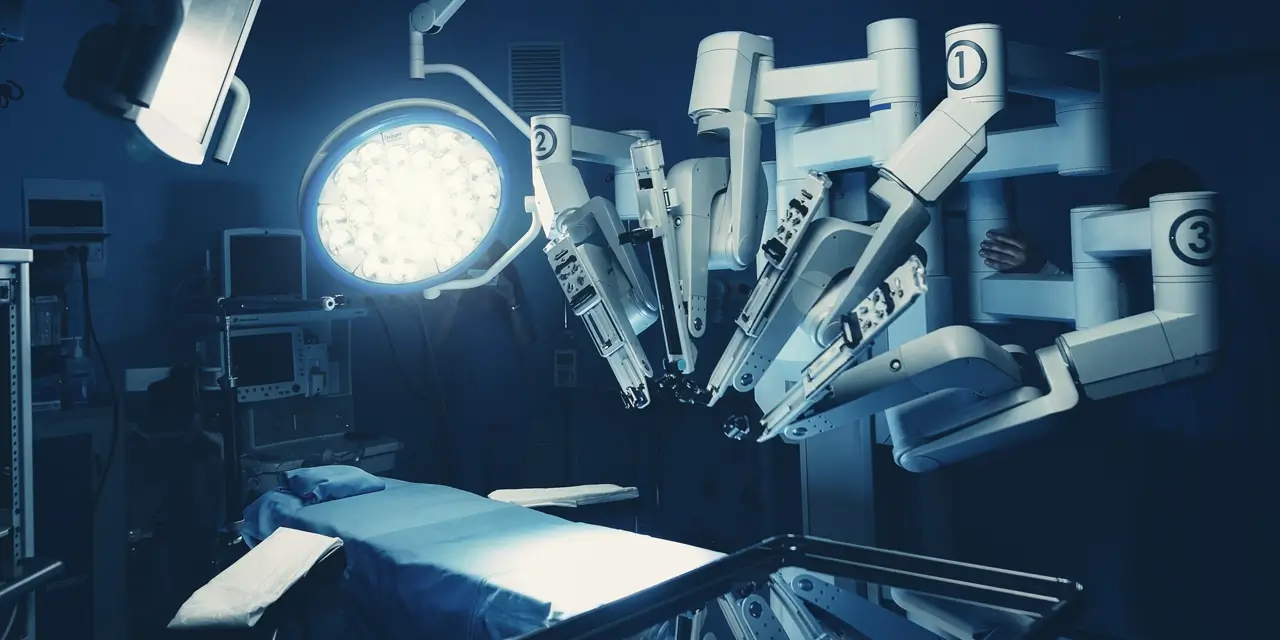

For investors looking for access to longer-term bonds, the Harvest Premium Yield Treasury ETF (HPYT) is an exchange-traded fund (ETF) that contains a portfolio of ETFs, which hold longer dated US Treasury bonds that are secured by the full faith of the United States government. This ETF employs a covered call writing strategy on up 100% of the portfolio holdings to generate a higher yield and maximize monthly cash flow. The exposure to longer-duration US Treasury government bonds and the covered call writing strategy being deployed on up to 100% of the ETF holdings by an experienced investment team, are two reasons why the ETF has attracted over $100 million in the first 60 days since its launch on September 28, 2023. The Harvest Investment team has combined 60 years + in managing money.

Of course, with the covered call strategy employed in HPYT, this means it that it aims to generate higher cash flow in the short-term than what is currently available in longer dated bonds, but still benefits from the diversification from long-term bonds. While not designed as barbell strategy, HPYT can deliver some of the benefits in that strategy. Specifically, HPYT aims to generate stable cashflow each month and by employing a covered call strategy on the portfolio of ETFs holding longer-date US bonds, help to reduce the downside risk. So, ultimately shaping the barbell bond strategy into a distinctive investment approach.