By Ambrose O’Callaghan

Canadian attitudes have shifted dramatically in response to heightened trade tensions between Canada and the United States, its closet ally. The new US administration has struck a predictably protectionist posture when it comes to trade policy in his second term. However, the aggressive tone targeting Canada’s trade, and even sovereignty, was unforeseen following the 2024 US election. Tariffs on steel, aluminum, and other products came into effect in March 2025. This has rattled markets, and investors now must wait with bated breath as a second round of “reciprocal tariffs” are on the table for April 2nd.

In this piece, we’ll look at how the Canadian economy fared coming into the New Year. Moreover, we will look at an exchange-traded fund (ETF) that offers exposure to Canada’s great companies. Let’ jump in.

Where does Canada stand in early 2025?

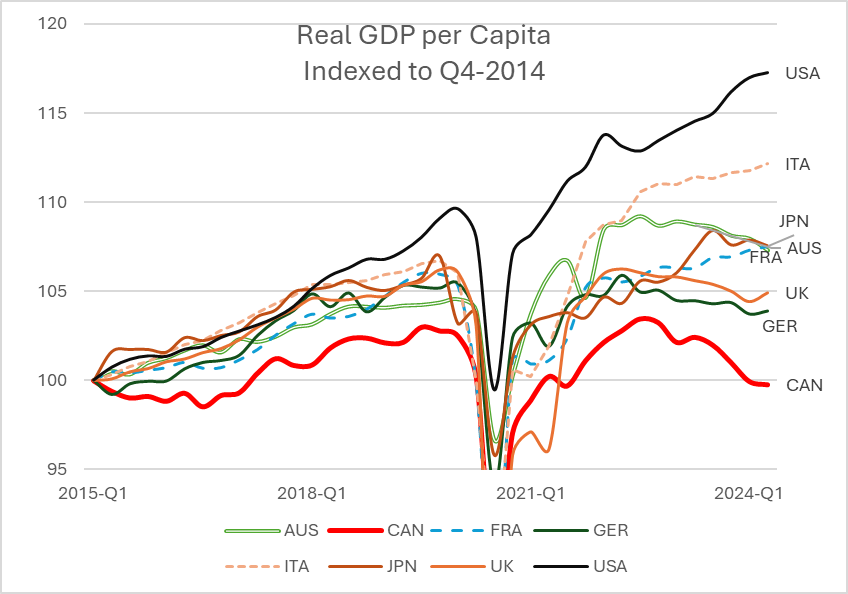

From an economic standpoint, Canada found itself in a difficult predicament in late 2024. The OECD chart below illustrates that Canada has fallen behind many of its peers in the post-COVID-19 pandemic era.

Source: Organization of Economic Cooperation and Development (OECD), 2024 Household Dashboard, accessed October 6, 2024.

Canada’s Real GDP per capita ranking compared to its peers, especially stand outs like the United States and Italy, has been abysmal. This is coupled with dismal employment statistics that have shown rising unemployment. Even positive jobs data is skewed by government hiring in some cases.

Indeed, unemployment in Canada has climbed from a low of 5% in 2022 to 6.5% in its latest reading. Royal Bank of Canada Deputy Chief Economist Nathan Janzen recently stated that unemployment would continue to rise to 7% by early 2025. That is nearly a percentage point higher than pre-pandemic levels.

The Bank of Canada (BoC) had already found itself in a tough spot as it battled a weak economic environment and a housing supply shortage that has kept prices elevated. It has now added the tariff and trade threat to the growing list of concerns. The BoC elected to proceed with a 25 basis point cut on March 12, 2025, bringing the benchmark rate to 2.75%.

Why should you trust Canadian companies?

Canada has been in a rut economically in recent years. However, the forward price-to-earnings ratio difference between the S&P TSX 60 and the S&P 500 show that publicly traded Canadian companies still offer attractive value at this stage. Canada is still home to many great companies that investors can rely on to generate consistent earnings. Many of these companies operate as oligopolies, generally meaning that they have very little competition.

Source: Bloomberg, October 8, 2024. Based on consensus blended forward 12-month price-to-earnings ratio.

As oligopolies, these companies are price setters- having the ability to easily change prices to their benefit. This means they can generate strong cash flows. This is at a time when a forward-looking market has discounted nearly the widest valuation gap between Canada and the United States in some two decades.

The Canada contrarian discussions may be increasing, but investors looking to pounce on an opportunity might want to consider HLIF. This is an ETF that offers exposure to many of Canada’s most dominant companies and has delivered high income every month since its inception.

HLIF | Canada’s top companies and high income every month

The Harvest Canadian Equity Income Leaders ETF (HLIF:TSX) seeks to capture the powerful traits of Canada’s leading companies. This portfolio of Canadian titans is overlayed with an active covered call strategy that allows for a maximum 33% write level. Canadians should recognize big names in this portfolio that include Scotiabank, Canadian Tire, Rogers, and Enbridge.

Summary

Canadians are wading through interesting times politically, economically, and socially at this juncture. Now they face what will likely be a contentious Canadian federal election this spring season. Meanwhile, the Canadian economy continues to pass through a rough patch. These conditions should not necessarily dissuade investors from seeking domestic exposure. Indeed, Canada is still home to very strong companies that generate consistent and high cash flow.

The Harvest Canadian Equity Income Leaders ETF – HLIF on the TSX – provides investors exposure to dominant Canadian companies. Moreover, it is overlayed with an active covered call strategy to generate high monthly cash distributions that are also tax efficient.

Disclaimer:

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional. The current yield is the annualized monthly distribution over the next 12 months as a percentage of the closing market price of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital.