By Harvest ETFs

Canada has a powerful combination of attractive traits for investors. Canadian banking, telecoms, energy, and utilities sectors are all characterized by a few large-cap companies with significant market shares. Those companies have healthy financial reserves, large market capitalization, competitive moats, and, in most cases, a long history of dividend payment. These traits make Canadian large-cap companies very attractive for long-term investors.

At the same time, the Canadian economy is highly dynamic. A longstanding hub for immigration, Canada benefits from an entrepreneurial and highly educated workforce, the world’s most educated according to OECD data. That drives growth through all layers of the Canadian economy, from banking, to utilities, to real estate.

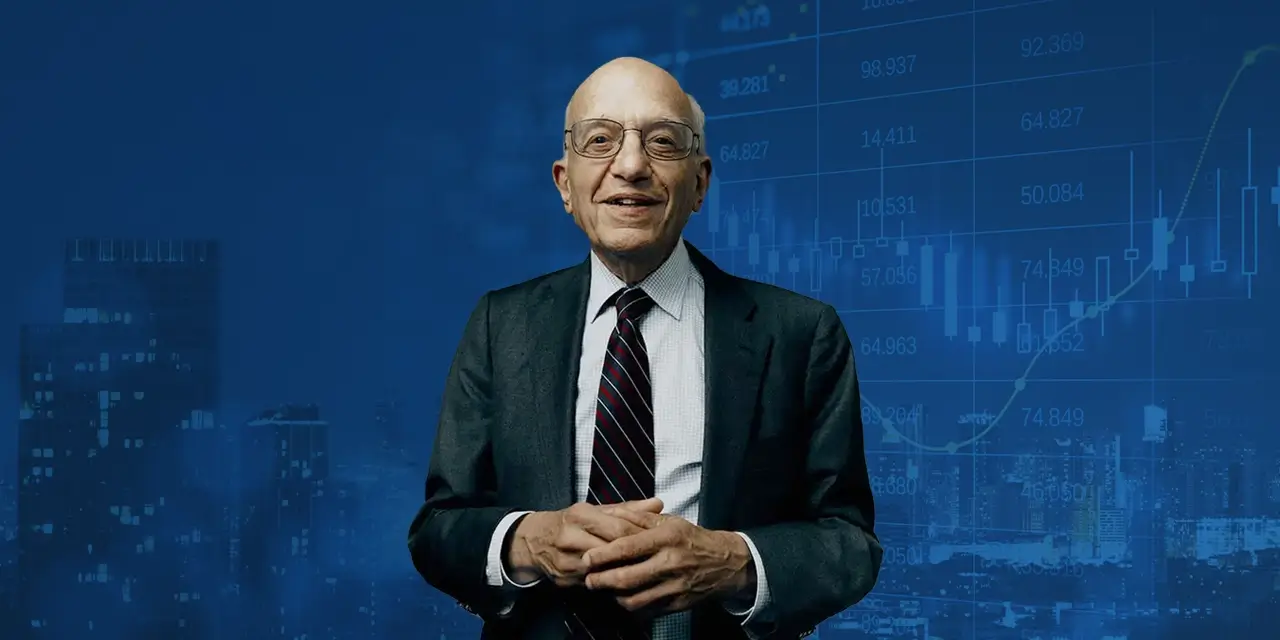

The Harvest Canadian Equity Leaders Income ETF (HLIF:TSX) was launched in June of 2022 to capture Canada’s dominant companies and economic dynamism. Harvest ETFs President & CEO Michael Kovacs explained why Harvest launched this ETF and how it captures the best traits in Canadian business.

Why did Harvest launch the Harvest Canadian Equity Leaders Income ETF?

“Outside of our Mutual Funds, Harvest did not have a Canadian Equity Income focused ETF and with some of the large cap quality businesses in Canada we felt it was time to add one to our lineup. At Harvest ETFs we focus on companies that demonstrate their quality through financial metrics and dominate their markets. Canada has many examples of those types of businesses.

“We have a history of delivering access to Canadian leaders, too. Our first ever mutual fund, the Harvest Banks and Buildings Income Fund, gives investors access to the Canadian banking and Real Estate sectors. HLIF gives Canadian investors access to a more diverse portfolio of prominent domestic companies within the ETF.”

How does this ETF capture the investment opportunities you see in Canada?

“Through our proprietary models and quantitative screens we have identified 30 large-cap Canadian companies that meet our criteria for long-term growth prospects, dividend yields, and underlying financial strength. The portfolio is value based and seeks higher yielding large-capitalization companies. So you will find well-known names from the banking and financial Industry, some materials and utilities, traditional energy and industrials. We have used an equal-weight allocation to these companies to make sure this ETF is appropriately diversified.”

What are some of the long-term performance tailwinds behind this ETF?

“We have a great banking sector in Canada, the world economic forum rated it as the second soundest in the world, and the ‘Big 5’ have huge market share. The telecoms, energy, and utilities sectors all have similar stories and have contributed to steady growth in corporate profits over the past decade.

“That growth has accelerated recently. According to statistics Canada, despite the pandemic Canadian quarterly corporate profits in Q4 of 2021 were around $120 billion more than they were in Q4 of 2019.

“Canada has an impressive mixture of dominant players and powerful fundamentals for investors to consider.”

How does this ETF deliver its 7% initial target Income Yield?

“HLIF, like all of our Equity Income ETFs, uses our active and dynamic covered call strategy to enhance income yield. This strategy allows our investment managers to generate additional premium income on up to 33% of each holding. In doing so we are monetizing some of the upside which also helps to lower the volatility.”

Who is this ETF for?

“Every investor is different and has different goals, but this ETF is built to give investors exposure to a core portfolio of dominant Canadian companies, with an attractive income yield. Income seeking investors, and those who want exposure to Canadian leaders, will find a total solution in the Canadian Equity Income Leaders ETF.”

To find out how your clients can benefit from this strategy call 1.866.998.8298.

For more on Harvest Equity Income ETFs click here.

|

By Michael KovacsPresident & CEO |