Reliable Income

Diverse growth opportunities

The Harvest Diversified Income ETFs is built to deliver the consistent monthly income and diverse growth opportunities that Harvest ETFs are known for

Harvest Diversified Income ETFs

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Harvest Diversified Income ETFs

Growth Themes

We are invested in long term growth. Harvest ETFs capture industries or secular mega-trends that have long term growth potential by investing in the companies we believe are best suited to participate in that growth.

Quality Businesses

We own quality businesses. We select leading companies with histories of success. They dominate their industries, they innovate, they lead, and their brand equity is measured by a long record of strong financial performance.

Consistent Income

We deliver income. Using a covered call option strategy we enhance the natural dividend yield of a portfolio to create attractive income. Covered calls may also reduce some of the volatility associated with equity investing.

Performance Catalysts

The Harvest Diversified Monthly Income ETF serves as a source of income and growth focus at a time when Canadian investors need both. It simplifies a complex universe of investable products, it provides stability through diversification across sectors and geographies, while applying modest leverage and a covered call strategy to achieve competitive yields.

Sub-Sector Allocation

As at May 30, 2025

HarvestETFs Portfolio Holdings

Harvest Healthcare

Leaders Income ETF

Harvest Tech Achievers

Growth & Income ETF

Harvest Brand Leaders Plus

Income ETF

Harvest Industrial Leaders

Income ETF

Harvest Global REIT Leaders

Income ETF

Harvest Equal Weight

Global Utilities Income ETF

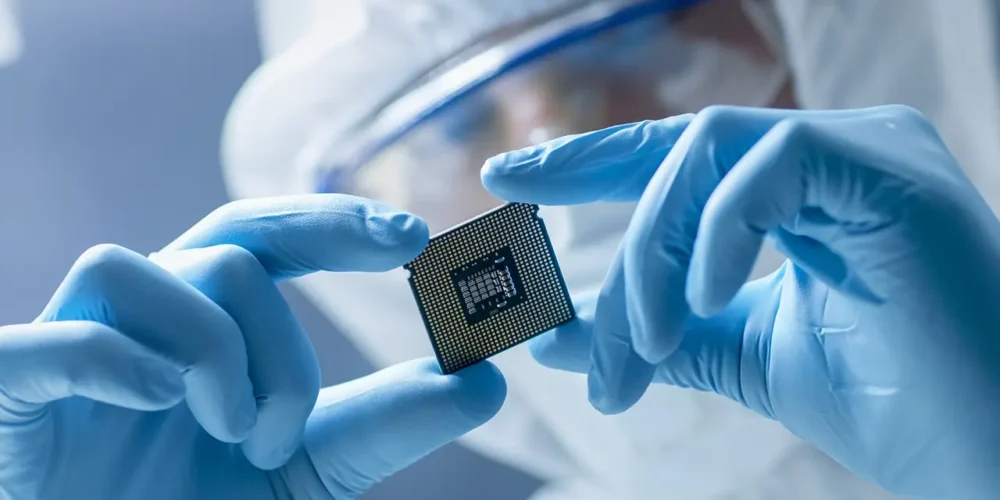

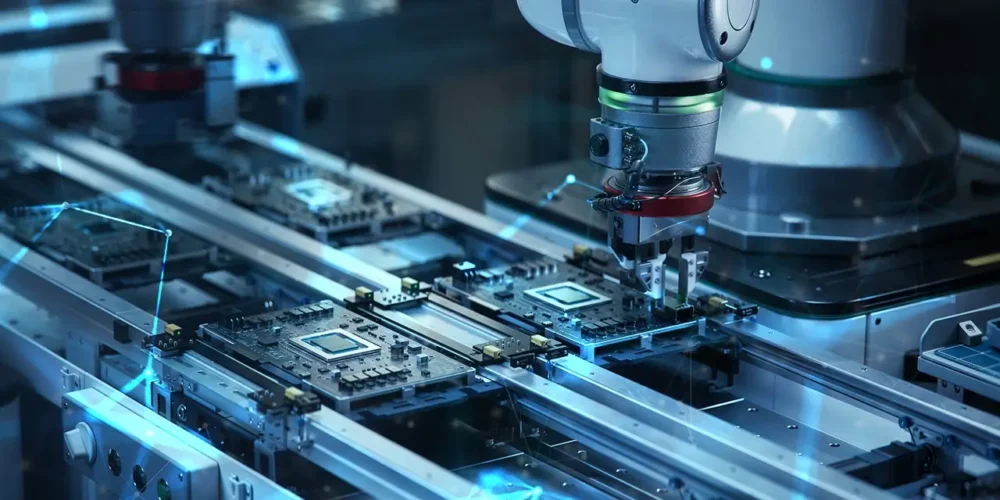

Evolutionary and Revolutionary Themes

Capturing value from major innovations.

Cloud Infrastructure

Artificial Intelligence

Big Data

Virtual/Augmented Reality

Communications

Cyber Security

Investing in Large-Cap Tech Companies

HTA & HTAE deliver exposure to a portfolio of 20 large-cap tech companies diversified across key sub-sectors.

As at April 30, 2025

A Tech + Income Strategy

HTA and HTAE have a high income component. They pay monthly cash distributions generated through an active and flexible covered call strategy. That income delivers the following benefits:

-

-

- High annualized yields paid as monthly distributions

- Downside protection via options premiums

- Volatility monetization

- Consistent monthly cashflows

-

The Harvest Tech Achievers Enhanced Income ETF (HTAE) adds roughly 25% leverage to its investment in HTA, delivering higher income and an elevated risk-return profile.

HTA and HTAE provide Canadian investors exposure to leading tech stocks with high income.

Tech Dominates the S&P 500

Did you know the Information Technology Sector now accounts for more than 25% of the S&P 500 index? And that doesn’t even include companies like Amazon, which are classified as consumer discretionary.

S&P 500 Breakdown

Source: Harvest ETFs, Bloomberg. As at April 30, 2025

Key Facts

As at 2025/06/06

TICKER

HTA

TSX

CURRENCY

CAD

Hedged

NAV

$17.86

Updated Daily

MKT PRICE CLOSE

$17.87

Updated Daily

NET AUM*

$713.81M

Updated Daily

MGMT STYLE

Active

With Covered Calls

CASH DISTRIBUTION***

Monthly

Frequency

LAST DISTRIBUTION

$0.1400

Cash, Per Unit

CURRENT YIELD

9.40%

Updated Daily

DISTRIBUTION

$9.4411

Total, Since Inception**

Key Facts

As at 2025/06/06

TICKER

HTAE

TSX

CURRENCY

CAD

Hedged

Underlying ETF

NAV

$15.81

Updated Daily

MKT PRICE CLOSE

$15.80

Updated Daily

NET AUM*

$86.93M

Updated Daily

MGMT STYLE

Active

With Covered Calls

Underlying ETF

CASH DISTRIBUTION***

Monthly

Frequency

LAST DISTRIBUTION

$0.1600

Cash, Per Unit

CURRENT YIELD

12.15%

Updated Daily

HOLDING

HTA

Underlying ETF

Key Facts

As at 2025/06/06

TICKER

HTA

TSX

CURRENCY

CAD

Hedged

NAV

$17.86

Updated Daily

MKT PRICE CLOSE

$17.87

Updated Daily

NET AUM*

$713.81M

Updated Daily

MGMT STYLE

Active

With Covered Calls

CASH DISTRIBUTIONS***

Monthly

Frequency

LAST DISTRIBUTION

$0.1400

Cash, Per Unit

CURRENT YIELD

9.40%

Updated Daily

DISTRIBUTION

$9.4411

Total, Since Inception**

Key Facts

As at 2025/06/06

TICKER

HTAE

TSX

CURRENCY

CAD

Hedged

Underlying ETF

NAV

$15.81

Updated Daily

MKT PRICE CLOSE

$15.80

Updated Daily

NET AUM*

$86.93M

Updated Daily

MGMT STYLE

Active

With Covered Calls

Underlying ETF

CASH DISTRIBUTION***

Monthly

Frequency

LAST DISTRIBUTION

$0.1600

Cash, Per Unit

CURRENT YIELD

12.15%

Updated Daily

HOLDING

HTA

Underlying ETF

An Award Winning ETF

At the end of 2024 HTA was named the Best Sector Equity Fund over 5 years – for its “U” class units and over 3 years for it's "B" class units by the Canadian LSEG Lipper Awards.

This recognition from a global industry leader validates the thesis behind HTA as a Canadian Technology ETF: that combining industry leaders with covered call option income can result in strong performance.

Meet the Manager

James Learmonth, CFA

James Learmonth is the Senior Portfolio Manager at Harvest ETFs and the lead manager for HTA and HTAE. James brings over two decades of experience, covering a wide range of equities and covered call options trading strategies. In addition to Harvest’s technology strategies, James currently leads portfolio management of Harvest’s Global Brands and US banking strategies and plays a key role in the execution of our covered call options trading.

Recent Technology Insights

Disclaimer

Harvest Tech Achievers Growth & Income ETF (HTA) originally commenced operations as a TSX listed closed-end fund on May 26, 2015 and converted into an exchange-traded fund on June 22, 2017.

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently and past performance may not be repeated.

Distributions are paid to you in cash unless you request, pursuant to your participation in a distribution reinvestment plan, that they be reinvested into the Class of units that you own of the Fund. If the Fund earns less than the amounts distributed, the difference is a return of capital. Tax, investment and all other decisions should be made with guidance from a qualified professional.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the ETF but represents the distribution an investor would receive if the most recent distribution stayed the same going forward.

* Represents aggregate AUM of all classes denominated in Canadian dollars.

** Inception Date: HTA Class A is 2015/05/26; HTA Class B is 2020/03/12; HTA Class U is 2017/06/22; HTAE is 2022/10/25.

*** In addition to cash distributions, the Fund could have notional non-cash distributions which are paid annually (if any). There is no impact on net asset value per unit. The notional distribution is added to the cost base of the ETF and is taxable if not held in a registered account (RRSP/RRIF/TFSA, FHSA and RESP).

LSEG Lipper Fund Awards, © 2024 LSEG. All rights reserved. Used under license.

The LSEG Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The LSEG Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is an objective, quantitative, risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the LSEG Lipper Fund Award. For more information, see lipperfundawards.com. Although LSEG Lipper makes reasonable efforts to ensure the accuracy and reliability of the data used to calculate the awards, their accuracy is not guaranteed.

Harvest Tech Achievers Growth & Income ETF

LSEG Lipper Fund Awards Canada 2024 Winner, Harvest Tech Achievers Growth & Income ETF Class U, Best Sector Equity Fund over five years, out of a total of 37 funds.

LSEG Lipper Fund Awards Canada 2024 Winner, Harvest Tech Achievers Growth & Income ETF Class B, Best Sector Equity Fund over three years, out of a total of 43 funds.

Where Can I Go to Invest?

Contact a Financial Advisor

Consult with your financial advisor to explore how Harvest funds may fit your investing objectives.

Buy Online

Invest in Harvest funds online through any leading brokerage platform with access to Canadian stock exchanges.

Ready to Invest?

Buying and selling our ETFs is simple: Investors can trade through their self-directed account, or contact their discount broker or financial advisor.

Below are links to some of the self directed brokerage firms available in Canada.

Use and access of third-party websites is at your own risk. Harvest ETFs is not responsible for financial advice, content, functionality or any other aspect of third-party sites. Harvest ETFs is not affiliated with any of these on-line financial service firms. Harvest ETFs will not be compensated by these firms when you place a trade or open an account. The listing of the on-line financial services firms above is not a recommendation or endorsement. By accessing the above websites, you are leaving the Harvest ETFs website and going to a 3rd party site that is independent of Harvest ETFs. Canadian investors may only purchase or trade Harvest ETFs through registered investment dealers, including but not limited to, the online brokerage firms listed above.