By Ambrose O’Callaghan

The United States Federal Reserve (Fed) slashed its key interest rate by 25 basis points on December 18, 2024. This marks the third consecutive rate cut this year, including the jumbo 50bp cut. That brought the policy rate from 5.5% at the start of the year to 4.5% as we approach the final days of the calendar year. The Fed instituted this policy to beat back runaway inflation that had taken hold after roughly two years of aggressive monetary easing and fiscal stimulus during the COVID-19 pandemic.

So, where does this leave investors as we head into 2025?

The 100 basis points of cuts in 2024 are not expected to be followed by dramatic rate cutting in 2025 due to the overall strength and resilience of the US economy. The Fed has developed a more hawkish tone driving longer term yields higher. The markets have quickly recalibrated to project only one full cut in 2025 as the Fed eases towards their target neutral rate. The Fed is now signaling potential for two cuts, down from the three indicated only a month ago in early November. Putting the estimates together, earlier in September, the market was looking for cut all the way to 3% in 2025. Today the market is expecting the Fed will stop when it gets between 4% or even 4.25% level.

How do Fed rate decisions impact bond and US Treasury yield?

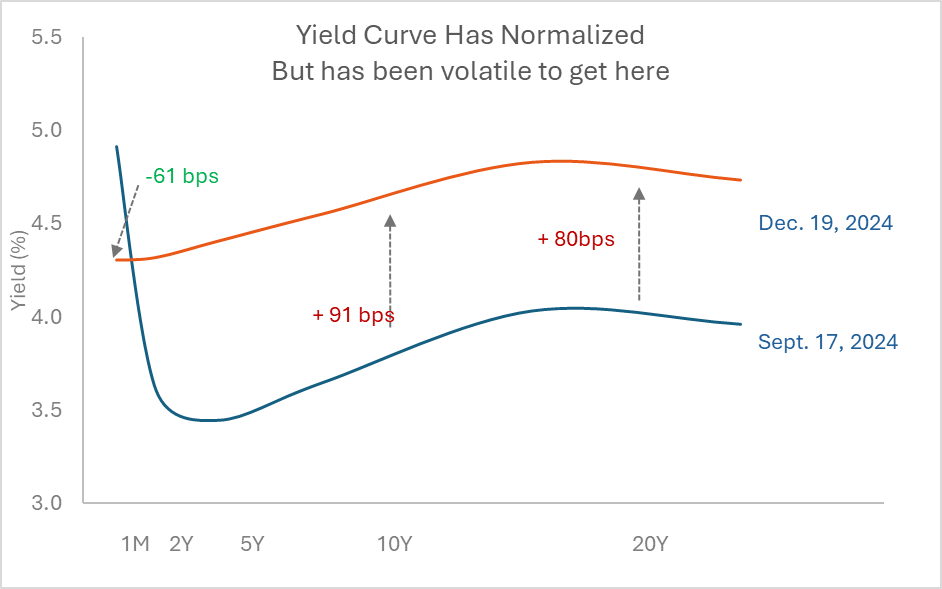

The December Fed interest rate cut impacts the shorter end of the yield curve however it does not necessarily mean that longer term rates will come down to track with it. On the contrary, long-term rates had been increasing leading up to the cut due to strong economic data that showed resilience in the US economy and the possibility of future inflation.

As the chart below illustrates, bond yields moved sharply lower despite the Fed not officially cutting from April through September.

Source: Bloomberg, US Government Yield Curve, October 24, 2024

More recently, longer term rates have been rising. That has applied pressure to long-term bond prices of longer durations as government bond prices are generally inversely related to interest rates.

Source: Bloomberg, US Government Yield Curve, Dec 19, 2024.

This trajectory for longer term bond prices is due to many factors. For example, stronger than expected economic data that has been released in the early fall season. For now this suggests that interest rates are going to stay relatively higher across the yield curve, nonetheless it’s worth highlighting that coming into 2022 the market was only expecting 2 rate hikes, we effectively got 15+ in that period. So, things can change very quickly, as we’ve seen even since September of this year.

The downturn in bond prices has been swift and the backup in yields has been beyond what we most expected. This is representative of a clear readjustment of market expectations. The underlying drivers this are the strong US economic macro backdrop, and the risks that incoming US policies might fuel inflation. That fuel for inflation could come from either tariffs or stimulus. With still a month to go until transition, we will see the slow unfolding of reality, and what has just been speculation.

In a recent piece covered why longer-term bonds and bond funds were in the spotlight after the Fed moved forward with its interest rate cut. You can check it out here.

Where are rates and bonds headed going forward?

At the point, it is clear that we have transitioned from an interest rate hiking cycle to an easing cycle. But of course, there are many variables dictating the outcome of whether we will experience a soft landing or a hard landing. For now, a soft landing appears to have been orchestrated. Meanwhile, investors should continue to expect market volatility and an environment that will be highly sensitive to economic data sets.

This has remained the case in the present. Moreover, the recent market dynamics have served to push volatility up from already elevated levels compared to the past ten years and remains spikey around data and policy speculation.

US Treasuries and high income from covered calls | HPYT and HPYM

Harvest ETFs applies an active covered call writing strategy on its stable of Income ETFs. By writing call options at varying levels, our portfolio management team can generate high income every month from option premiums. As volatility rises, option premiums tend to increase.

There will be volatility when investing in a bond-focused covered call writing strategy. Moreover, that strategy will forego some of the upside as interest rates continue to decline. However, the trade-off in this strategy is that there is substantial cash-flow generation from option premiums. That generates high monthly income that is also tax efficient.

The Harvest Premium Yield Treasury ETF (HPYT:TSX) offers access to high-quality US Treasury bonds via US-listed ETFs. That portfolio is overlayed with an active covered call strategy. HPYT has delivered monthly cash distributions of $0.15 per unit every single month since its launch. This represents a current yield of 18% as at December 19, 2024. That works out to $2.10 in total distributions paid per unit over that period.

Annualized Performance

As at November 30, 2024

In January 2024, we launched the Harvest Premium Yield 7-10 Year Treasury ETF (HPYM:TSX). This fixed income ETF offers access to high-quality mid-duration US Treasury bonds via US-listed ETFs. It is overlayed with an active covered call strategy that has generated monthly cash distributions of $0.08 per unit over its lifespan.

Disclaimer:

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.

The current yield represents an annualized amount that is comprised of 12 unchanged monthly distributions (using the most recent month’s distribution figure multiplied by 12) as a percentage of the closing market price of the Fund. The current yield does not represent historical returns of the ETF.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.