By Ambrose O’Callaghan

On Wednesday, September 18, 2024, the US Federal Reserve (the Fed) announced an interest rate cut of 50 basis points to its benchmark rate. There is a perception among some investors that real estate and/or REITs have the same inverse relationship with interest rates as bonds generally do. Today, I want to provide context beyond the “Rates Down = REITs Up” interpretation.

A Real Estate Investment Trust (REIT) is a company that owns and often operates real estate that generates income. REITs can own various types of commercial and residential real estate, including industrial warehouses, office and apartment buildings, hospitals, hotels, shopping centers, and even community forests.

REITs are a popular investment among Canadians. However, most REIT-focused exchange-traded funds (ETFs) are heavily weighted in domestic REITs.

In this piece, I want to explore the benefits of a portfolio of globally diversified REITs. Moreover, I will examine how the current rate environment could impact REITs going forward. Let’s jump in.

What are the benefits of a global REIT portfolio?

Global REITs have managed to build momentum in the late summer and early autumn as monetary policy has softened, at least in the developed world. The first Fed rate cut in four years likely sets the tone for a period of loosening rate policy in the months ahead. Harvest’s investment team believes there is an opportunity for global REITs in this environment.

The scale of global REITs is many times larger than the Canadian REIT market. As the chart below illustrates, global REITs offer significant breadth of companies across differentiated sub-industries.

Source: Harvest Portfolios Group, 2024.

Canadians who own a global REIT portfolio also get exposure to the diverse economic realities that exist in different countries. A global portfolio like Harvest Global REIT Leaders Income ETF (HGR:TSX) could potentially provide protection against the downside in any one country’s REIT basket.

HGR also offers access to growth in sunbelt region apartments, where the US population is seeing positive net migration. On the retail side, HGR is focused on grocery-anchored tenants, banks, pharmacies, and more staple-like businesses. In Healthcare, HGR has sought to diversify beyond senior homes. Indeed, it has expanded its focus into areas like healthcare/technology-integrated campuses.

Further, HGR is exposed to the specialty REIT category. This category focuses on secular growth themes like the rise of communication. Generative AI, popularized among the investing public with the rise of ChatGPT and its imitators, is a key growth driver in the Tower sector and the Data center space. This is also an opportunity that existed in the Harvest Equal Weight Global Utilities Income ETF (HUTL:TSX). HGR also provides exposure to storage REITs, another fast-growing sub-sector right now.

Source: Harvest Portfolios Group, 2024.

Why REITs now?

Historically, a softening interest rate environment has led to a strong performance for REITs – both global and domestic. Of course, the economic situation that we face continues to be fluid. There are positive signs for the “soft landing” scenario that was laid out by our team in late 2023, but there is still the possibility that we will experience an economic “hard landing” in the United States, Canada, and globally.

REITs have had a mixed performance in a “hard landing” scenario, as the chart below illustrates. Recessions that have followed rate hikes produce an unpredictable environment for the market.

Source: Harvest Portfolios Group, 2024.

Source: Harvest Portfolios Group, 2024.

HGR | High income and growth from global REITs

The HGR ETF combines income from REITs in the US, Europe, an Asia, overlayed with an active covered call writing strategy to generate high income every month.

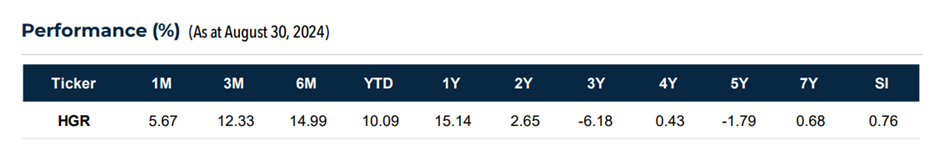

HGR has performed well in anticipation of the September interest rate cut. The ETF rose to a 52-week high of $6.68 per unit in mid-September on the back of that momentum. HGR has climbed 10.09% in the year-to-date period as at August 31, 2024 and is up 15.14% in the year-over-year period.

Source: Harvest Portfolios Group, 2024.

Harvest ETFs is one of the largest covered call providers in Canada. Its trusted covered call writing strategy has generated over C$1 billion in total ETF distributions since it launched its Income ETF lineup in 2016. HGR has continued to deliver high income every month through its active covered call writing strategy. This REIT offers a monthly distribution of $0.0458 per unit. That represents a current yield of 8.25% as at September 23, 2024.

This ETF is generally managed to be a complete diversified portfolio of REITs in sub-categories that can be very different than each other on a fundamental level. The ETF is certainly more diverse than the traditional office, retail plaza, and apartment building that most may think about when they turn to REITs.

These factors, including falling interest rates, growth drivers like AI power demand that exist in the global REIT market, could point to an opportunity in the global REIT space right now. HGR offers access to the world’s biggest players in the REIT space, overlayed with an active covered call writing strategy to generate high income, every month.

Disclaimer

Commissions, management fees and expenses all may be associated with investing in Harvest Exchange Traded Funds (managed by Harvest Portfolios Group Inc.). Please read the relevant prospectus before investing. The indicated rates of return are the historical annual compounded total returns (except for figures of one year or less, which are simple total returns) including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The funds are not guaranteed, their values change frequently, and past performance may not be repeated. Tax investment and all other decisions should be made with guidance from a qualified professional.

Certain statements included in this communication constitute forward-looking statements (“FLS”), including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Fund. The FLS are not historical facts but reflect Harvest’s, the Manager of the Fund, current expectations regarding future results or events. These FLS statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although Harvest, the Manager of the Fund, believes that the assumptions inherent in the FLS are reasonable, FLS are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. Harvest, the Manager of the Fund, undertakes no obligation to update publicly or otherwise revise any FLS or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.