Paul MacDonald, Chief Investment Officer, Portfolio Manager, Harvest Portfolios Group Inc.

INVESTORS LIKE DIVIDEND STOCKSDividend stocks have been a foundational investment for some time and are generally preferred by the large cohort of investors seeking income.

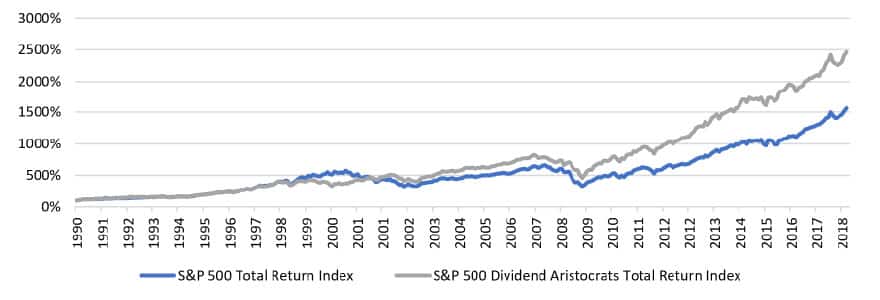

Getting the occasional dividend bump has also generated more than just a pleasant surprise. Strategies focused on long term dividend growth have handily outperformed the markets over the past 25+ years.Dividend Growth – Long Term Performance

Source: Bloomberg, Harvest Portfolios Group Inc., Aug. 31/18. Normalized to Dec. 31/90.

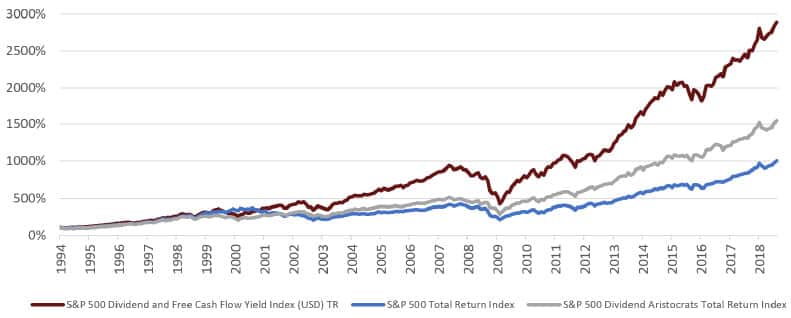

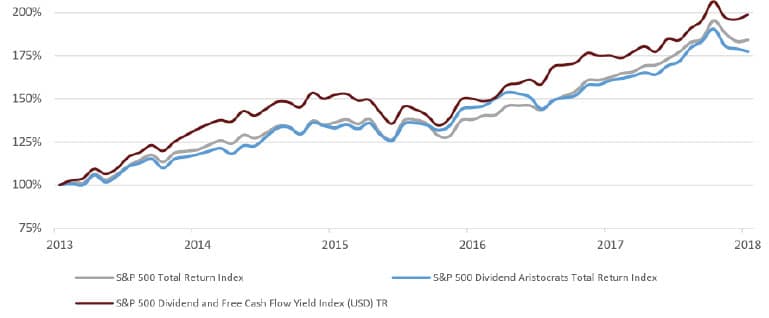

What is less apparent is why dividend growth strategies have outperformed. Strong businesses with abundant and growing free cash flow have capacity to increase dividends. Indeed, adding free cash flow to the equation may help explain the outsized returns by dividend growers.Adding Free Cash Flow With Dividend Yields = Strong Outperformance

Source: Bloomberg, Harvest Portfolios Group Inc., Aug. 31/18. Normalized to 100, Dec. 31/93.

PERFORMANCE WANING

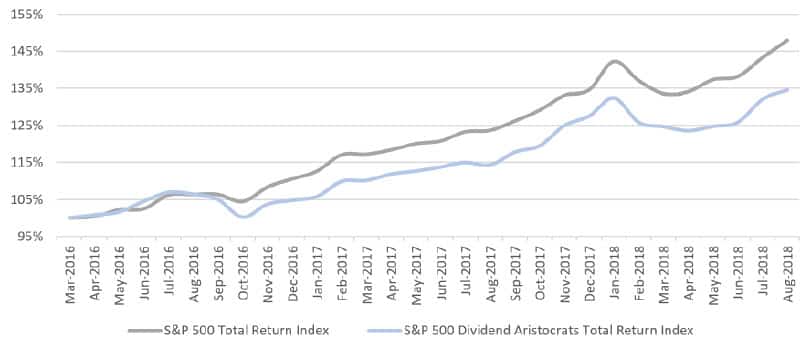

While its hard to fault a long-term dividend growth strategy, the outperformance has slowed over recent history. For the 5-year period ending August 31, 2018, the strategy has in fact lagged the S&P 500.

Source: Bloomberg, Harvest Portfolios Group Inc., Aug. 31/18. Normalized to 100, Dec. 31/93.

PERFORMANCE WANING

While its hard to fault a long-term dividend growth strategy, the outperformance has slowed over recent history. For the 5-year period ending August 31, 2018, the strategy has in fact lagged the S&P 500.

Dividend Growers – Shorter Term Lag

The breadth of underperformance over the past two years has also widened.

Performance Lag is Widening

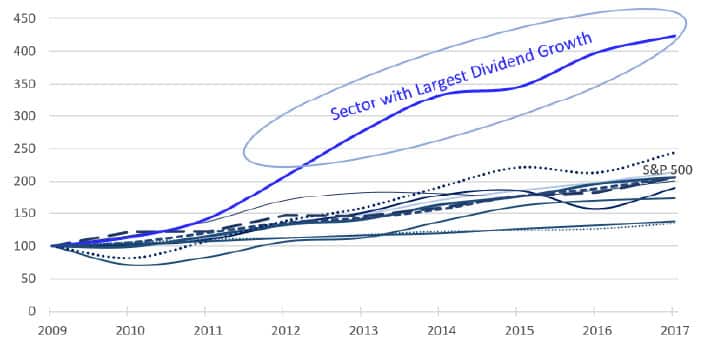

DIVIDEND GROWTH IS MISSING DIVIDEND GROWTH

What is not so obvious is that many dividend growth focused strategies are in fact missing out on the segments of the market with the best dividend growth. The same areas of the market that have structurally positive long-term growth dynamics, are generating tremendous free cash flow and delivering strong growth:Sector Dividend Growth

Source: S&P 500 Sub- Sectors; Bloomberg, Harvest Portfolios Group Inc., Aug. 31/18. Annual data normalized to Dec. 31/09.

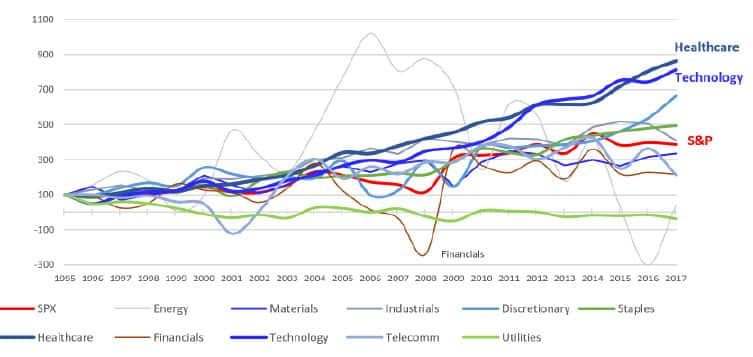

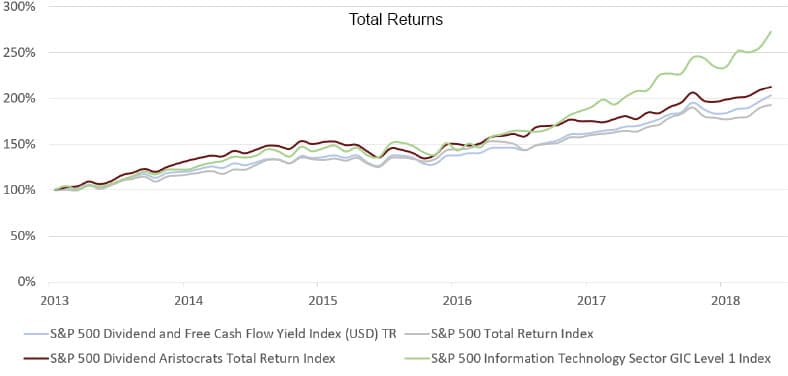

The S&P 500 Technology sector has had the highest compound annual dividend per share growth over the past several years. The sector has also delivered amongst the strongest free cash flow growth over the past 20+ years.Free Cash Flow/Share Growth

Source: Bloomberg, Based on trailing 12 month free cash flow. Harvest Portfolios Group Inc. Annual data normalized to Dec. 31/95

Despite the Technology sectors strong short-term and medium-term dividend and cash flow growth, some dividend growth strategies are up to 20% underweight the sector. To be clear – income is good, dividend growth is good. Having the flexibility to incorporate the metrics that capitalize on segments of the market that have structurally positive long-term growth drivers, are delivering all star financial metrics and bumping dividend metrics.Technology Complements Dividend Growth

Source: Bloomberg, Harvest Portfolios Group Inc., Aug. 31/18. Normalized to Apr. 30/13.

Savvy investors understand that for income, technology stocks generally offer relatively lower yields.

ONE STRATEGY TO ENHANCE INCOME IS TO USE COVERED CALLS Harvest Portfolios Group Inc., utilizes a combination of quantitative financial metrics including dividend and free cash flow growth within their Income orientated ETF’s. For those looking to complement an existing dividend growth strategy – the Harvest Tech Achievers Growth & Income ETF (TSX: HTA) has an attractive tax efficient yield. Harvest’s broader based strategy, the Harvest Brand Leaders Plus Income ETF (TSX: HBF) holds 20 positions that read like the who’s who of the dividend elite, also incorporates metrics like free cash flow, dividend growth, brand value and other financial metrics. The ETF (TSX:HBF) has benefited from a solid overweight position within the technology sub-sector and has been a key driver of the ETF’s positive risk adjusted returns.Advisor Use Only. You will usually pay brokerage fees to your dealer if you purchase or sell units of the Fund(s) on the TSX. If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of the Fund(s) and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units of an investment fund. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents.

Certain statements in this communication are forward looking Forward-looking statements (“FLS”) are statements that are predictive in nature, depend upon or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” or “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions, which include, amongst other things, that (i) the Fund can attract and maintain investors and have sufficient capital under management to affect their investment strategies, (ii) the investment strategies will produce the results intended by the portfolio managers, and (iii) the markets will react and perform in a manner consistent with the investment strategies. Although the FLS contained herein are based upon what the portfolio manager believes to be reasonable assumptions, the portfolio manager cannot assure that actual results will be consistent with these FLS. Unless required by applicable law, Harvest Portfolios Group Inc. does not undertake, and specifically disclaim, any intention or obligation to update or revise any FLS, whether as a result of new information, future events or otherwise.