By Harvest ETFs

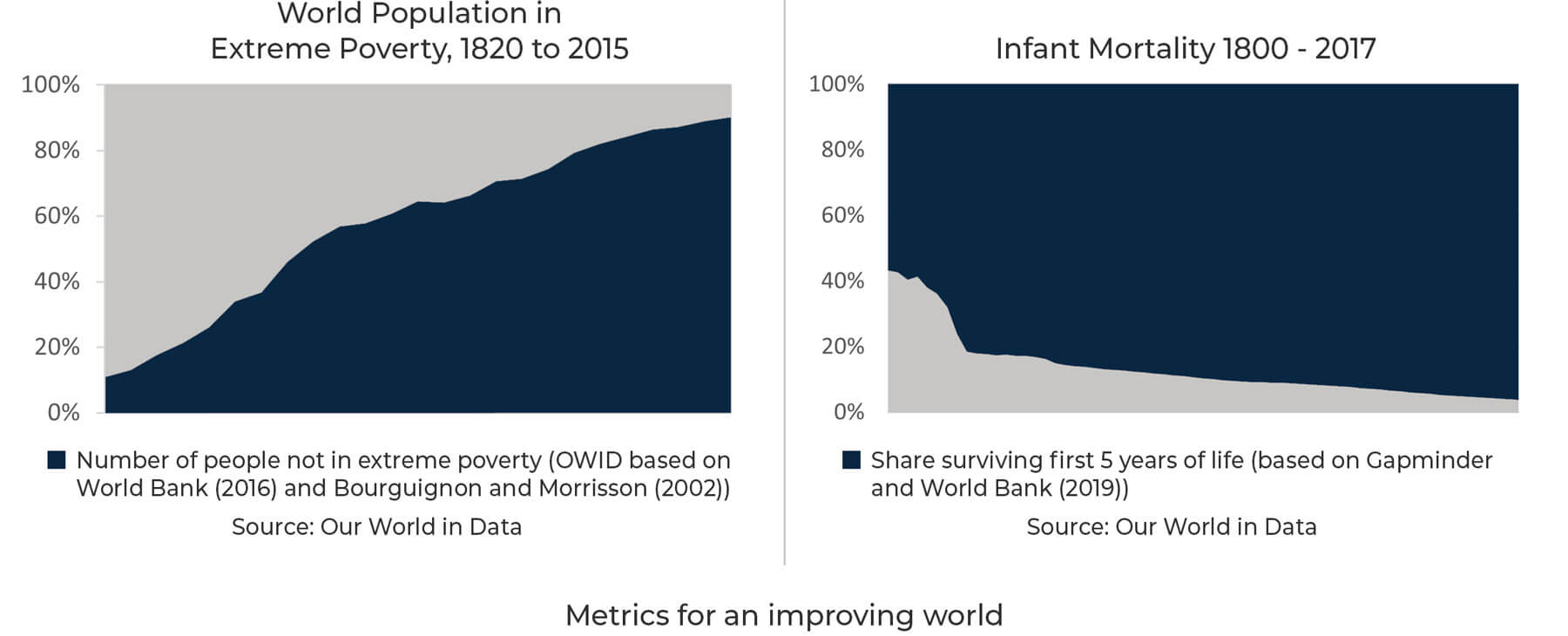

Businesses create wealth. It’s a fact of modern history that the past two centuries’ massive global improvements in GDP, standards of living, and life expectancy have been powered by private enterprise. That fact sits at the core of Harvest ETFs’ investment philosophy.

At Harvest ETFs, we believe that investors can build and secure wealth by owning high-quality businesses for the long term. Our investment philosophy involves three key steps: finding growth industries or economic mega-trends, identifying the best-positioned businesses to capture that growth opportunity, and, when the sector is suited to delivering income, generating monthly cashflows on holdings of those businesses.

Growth Industries, quality businesses, and cashflow form the keys to our investment philosophy. Sticking to that simple formula for success is what has made our ETFs stand out in the Canadian market.

Seeking Capital Growth through Growth Industries & Mega-Trends

The first key to Harvest’s investment philosophy is to identify investable areas with long-term growth prospects. Unlike many other fund issuers or investment management companies, however, we look beyond individual market sectors towards growth industries and “Mega-Trends.”

We define Mega-Trends as areas of opportunity created by rapid changes or societal acceptance of new industries for long-term investors. They defy the traditional categorization of sectors. For example, the rise of Blockchain technology across a huge variety of industries: from cryptocurrency miners to large-cap tech companies to decentralized finance providers.

We build our ETFs to capture these growth industries and Mega-Trends because we see their huge potential to power growth in the long-term. One of our core product lines, our Equity Growth Focused ETFs, offer pure-play exposure to those Mega-Trends and their opportunities for capital appreciation opportunity.

Why We Own Quality Businesses

The second key to Harvest’s philosophy is to find the companies that have the best performance prospects in both up and down markets. Our approach hinges on quality businesses. Quality is a bit of a subjective term, especially when it comes to investments. Our vision for quality at Harvest is a vision for the best companies to hold for long-term capital appreciation.

That’s a vision that we have honed over time. It begins with our founder and CEO, Michael Kovacs, who brings 35+ years of investment industry experience to his leadership at Harvest. It’s supplemented by our portfolio management team, all CFAs with a combined 60+ years of experience managing investments. Together, they identify key sectors and growth industries that offer great long-term growth prospects and income potential for investors.

Once the qualitative value of a sector or growth industry has been identified, the Harvest team then applies quantitative screens, to filter out companies that lack the underlying financial resilience to be considered a high-quality long-term investment.

With a larger filtered basket created, Harvest’s experienced leaders and portfolio managers take over once again to choose the companies they see as strongest for a long-term investment strategy or best suited to fit the unique goals of an ETF.

Turning Equities into Cashflow

The final key to Harvest’s philosophy is to generate income from portfolios of high-quality companies.

Harvest’s suite of equity income ETFs are built to deliver that cashflow for investors, whether they need it for retirement or not. These portfolios meet our high standard for quality and capture long-term growth prospects of their own. But, they have a powerful strategy overlaid on their holdings to deliver income.

Income generation for these ETFs is derived largely from covered call strategies. A covered call ETF uses call options sold on behalf of the ETF by the portfolio management team to generate premiums on some of the ETF holdings. These premiums are then passed on to investors in the form of tax-efficient income.

Call option writing offsets some of both the upside and downside of an ETF’s performance. However, our strict 33% write limits allow for continued participation in the long-term capital appreciation opportunity from these ETFs while they continue to generate steady monthly income.

Harvest’s suite of equity income ETFs encompasses a range of strategies, from more defensive to more growth oriented. Their income yields can range from around 5% to at or above 8.5%. They all share one common principle, however, income generation through the ownership of high-quality businesses.

Three Keys to the Harvest Philosophy

These three keys work in tandem in Harvest’s suite of ETFs. All our products begin with the identification of growth industries that we think are ideal for long-term investments. Our portfolios are built of high-quality businesses as we define them, with strict quantitative and qualitative screens. Our cashflow-generating products use the power of covered call strategies to generate the income that so many investors need. Together, those three keys form our investment philosophy.

It’s a philosophy that we stick to. We do what we say we’re going to do, maintaining our focus and holding true to our philosophy because we know how powerful it is.

To find out how your clients can benefit from this strategy call Harvest ETFs 1-866-998-8298.

For more on Harvest Equity Income ETFs & Harvest Growth Income ETFs click here.