Harvest offers a suite of ETFs divided between equity income-oriented ETFs and equity growth-focused ETFs. The equity growth focused ETFs generally offer more opportunity for capital appreciation. They focus on investable emerging themes and mega-trends which over time can generate powerful returns.

One of those themes is the emerging use of blockchain technology. Harvest’s Blockchain Technologies ETF (TSX:HBLK) holds companies involved in blockchain applications, that include cloud computing, artificial intelligence, and e-commerce. Another is Harvest Travel & Leisure Index ETF (TSX:TRVL) where demographic trends and consumer preferences across the globe are powering long-term growth for the travel sector. A third growth focused ETF, the Harvest Clean Energy ETF (TSX:HCLN) captures the long-term growth prospects in clean energy. The transition away from fossil fuels is just beginning and will accelerate over the next few decades. As the sector evolves, investments in wind, solar and hydro will grow.

The companies held in these ETFs follow the Harvest investment philosophy of investing in companies that Harvest has identified with the greatest potential to provide growth opportunities for the specific industry or mega-trend. These companies are the leaders in their industries and offer a long-term opportunity for investors to grow with them.

Here’s a closer look:

HBLK was launched in 2018 and was Canada’s first blockchain ETF. It holds a cross section of large capitalization technology companies and emerging stand-alone blockchain companies. The ETF’s holdings are designed to evolve as the industry matures.

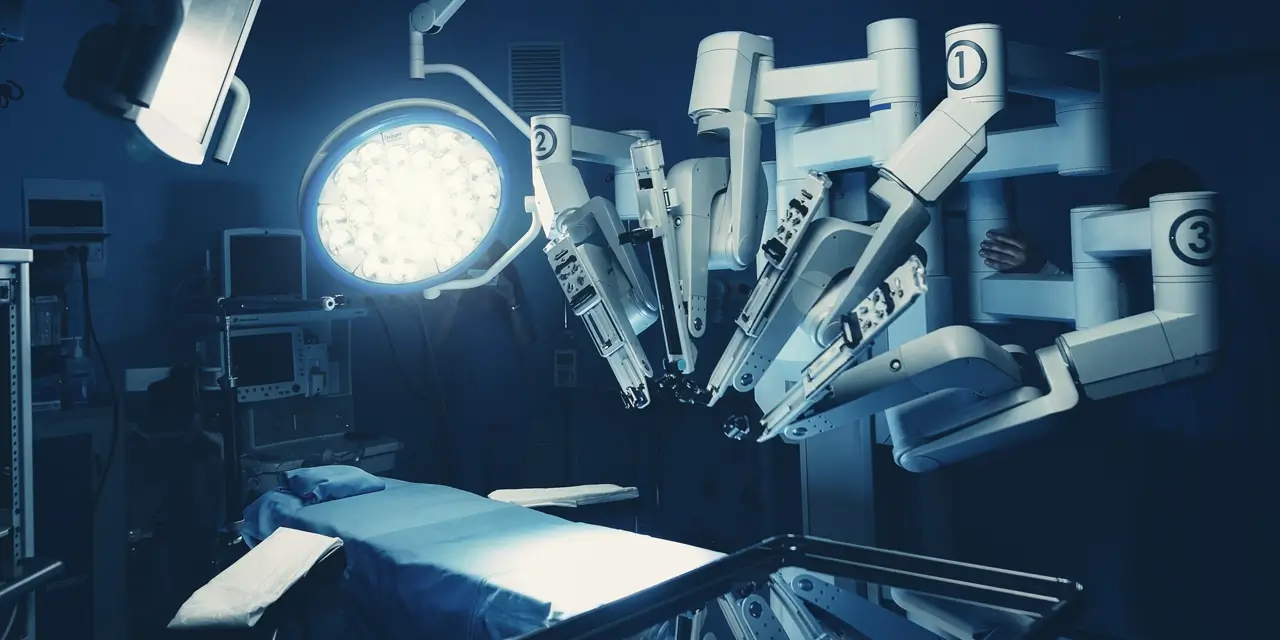

The power of blockchain lies in its unique ledger-sharing capabilities. Once entries are made to an electronic contract, agreement or shared document, the entries cannot be changed. Everyone can see the transaction details as they are entered and the time. It makes them tamper proof.

So while cryptocurrencies grab headlines, the potential has spread to most sectors. These include governments, insurance, financial services, healthcare, food safety, and transportation logistics. Blockchain is being used to make existing tasks more efficient and less open to fraud.

The wide adoption of Blockchain technologies has resulted in a broadly diversified ETF holding over 50 equities. Just under 25% of assets are in software and tech services while around 20% is in large cap tech companies like IBM and Microsoft. Crypto trading and wallets form just under 20% of the portfolio while Crypto miners and other blockchain companies each hold about 10% of the allocation. The remaining portfolio is split between payment processors, digital assets and services, decentralized finance, and transaction processing.

This globally diversified ETF holds 30 stocks and captures rising demand for travel in the developing world and increasing leisure in the developed world. TRVL follows the Solactive Travel & Leisure Index.

The industry felt the full force of the pandemic, but the underlying trends are strong. Along with rising global affluence and increasing leisure travel by an older demographic, millennials have arrived. They are looking for experience-related travel and are comfortable using online booking sites which make travel more accessible and affordable.

Currently, hotels, resorts and lodgings including the Hilton and Marriott hotel chains make up the largest component of the ETF. Airlines, mainly U.S.-based, form the second-largest subsector, though the ETF includes Air Canada. The other components are in casinos & gaming, booking sites including Expedia Inc., as well as Cruise lines such as Royal Caribbean, Carnival Corp. and Norwegian Cruise Lines. TRVL’s management fee is 0.40%.

HCLN holds 40 of the largest global clean energy companies by market capitalization. The ETF is equally weighted and rebalanced semi-annually. The long-term drivers fuelling the growth of this sector include: rising global power demand, innovation that has improved clean energy’s cost competitiveness, collaborative global government policies that give incentives for investment, declining costs and rising renewable capacity.

HCLN is focused on renewable power producers and related equipment and services, such as wind turbines and solar panels. Geographically, the current holdings are invested in securities based in North American and Europe, with regional breakdowns of the holdings mainly based in North America and Europe, with select investments in: New Zealand, China, and the U.K. among others.

To find out how your clients can benefit from these equity income solutions call 1.866.998.8298.

For more on Harvest growth focused products click here.